A Beginner’s Guide to Investing in ETFs: Making Sense of the Market

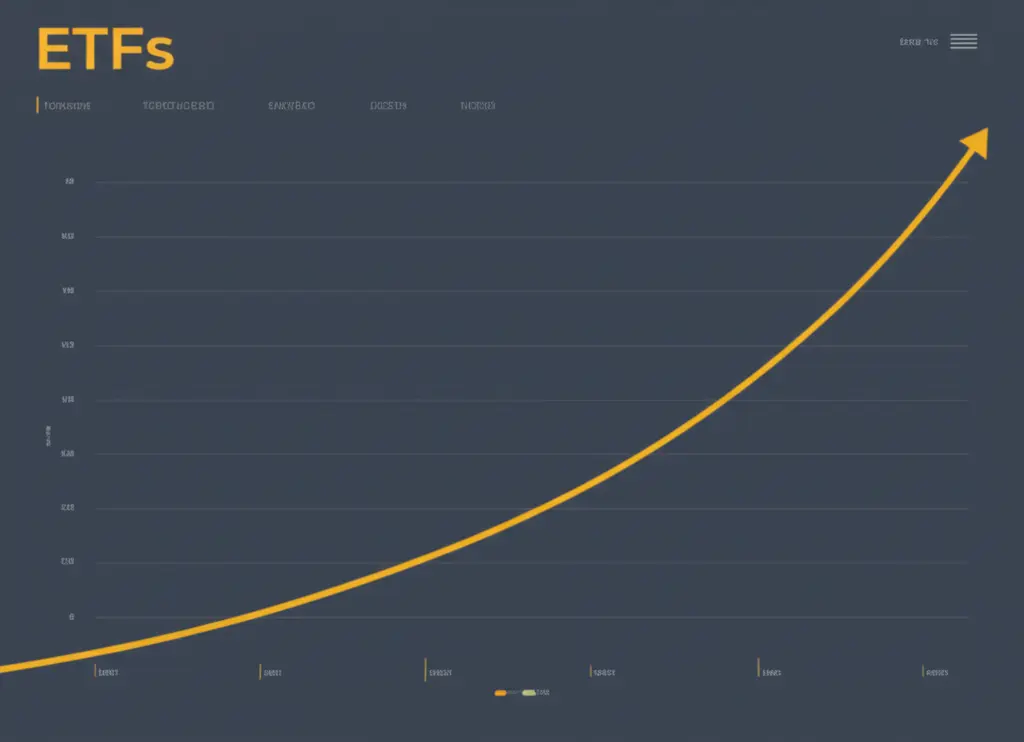

Discover the essentials of investing in ETFs for beginners.

Have you ever felt overwhelmed by the sheer number of investment options out there? If you're nodding along, you're not alone. Navigating the world of stocks, bonds, and mutual funds can feel like learning a new language. But today, I'm here to demystify one of the most flexible and beginner-friendly investment vehicles out there: ETFs, or exchange-traded funds.

What Are ETFs Anyway?

If you're just starting your investment journey, ETFs might feel like just another confusing acronym. Simply put, an ETF is a basket of securities that you can buy or sell through a brokerage firm on a stock exchange. They're pretty similar to mutual funds but with a critical difference: they trade like individual stocks on an exchange.

Why Choose ETFs?

So, why should you consider ETFs for your investment strategy? Here are a few compelling reasons that I've found make ETFs particularly appealing to new investors:

- Diversification: Investing in a single ETF could give you exposure to hundreds of different stocks or bonds.

- Cost-effective: Most ETFs have lower expense ratios compared to mutual funds, meaning more money stays in your pocket.

- Flexibility: ETFs trade like a stock, allowing you to buy or sell throughout the trading day. This flexibility can be crucial for those who want to react quickly.

How to Start Investing in ETFs

Now that you're hooked on the idea of ETFs, how can you start investing in them? Let me guide you through a simple process to get started:

1. Choose a Brokerage

First, you need to open a brokerage account. Look for one with low fees and an intuitive platform. Many brokerages offer commission-free trading on many ETFs, which is a definite plus.

2. Research ETFs

It’s important to know what you’re buying. You can find ETFs focused on different sectors, geographic areas, or investment styles. Consider your risk tolerance and investment goals when choosing an ETF.

3. Go for It!

Once you’ve selected an ETF, you can place your order. Remember, since ETFs are bought and sold like stocks, you can choose between different order types such as market or limit orders.

Key Points to Remember

Like any investment, ETFs carry risks. Market fluctuations can affect the value of your investment, but a diversified portfolio can help mitigate this. Also, keep an eye on ETF expenses and choose those that align with your investment strategy.

In Conclusion: ETFs are a compelling option for those looking to dip their toes into investing without diving headfirst into the complicated world of stock picking. They offer a great balance of flexibility, cost-effectiveness, and diversification. Ready to start your ETF journey? Let me know your thoughts or questions in the comments below!