A Beginner's Guide to Smart Investing: Navigating the Financial World with Confidence

Discover simple ways to start investing with confidence! Learn strategies for beginners, tips, and practical advice on growing your wealth.

Have you ever felt like the world of investment is a confusing maze complicated by buzzwords and unending choices? You're not alone! Many people just like you are eager to dive into investing but don't know where to start. Let's leave the complexity behind and uncover a practical pathway to smart investing together.

Understanding Your Financial Goals

Before you jump into any investment, it's crucial to understand your financial goals. Ask yourself: What do I want to achieve with my investments? Maybe it's a comfy retirement, funding your children's education, or simply growing your wealth over time.

"Understanding your goals is like packing a map for your financial journey."

Once you're clear about your destination, you can choose the right investment vehicle to get you there.

Creating a Budget for Investment

Let's talk numbers! Before you start investing, it's essential to have a budget. Allocate a portion of your income specifically for investments. A simple strategy is the 50/30/20 rule: 50% for necessities, 30% for wants, and 20% for savings and investments.

- Necessities: Housing, utilities, groceries.

- Wants: Entertainment, dining out, hobbies.

- Savings & Investments: Emergency fund, retirement accounts, stocks.

Setting a clear budget keeps your investments consistent, allowing them to grow over time.

Diversification: Why It Matters

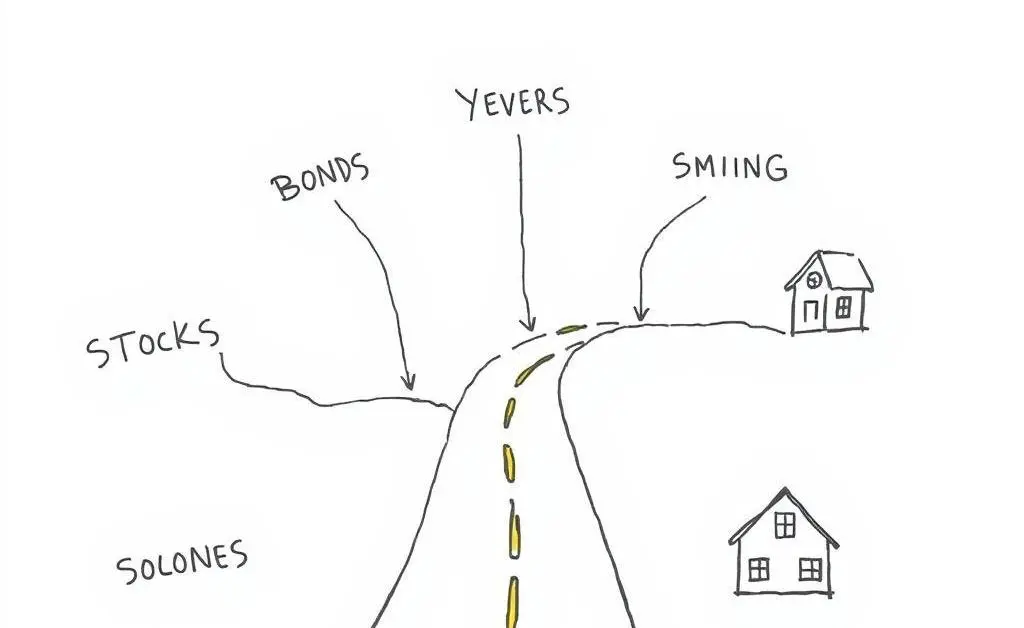

You've probably heard the saying, "Don't put all your eggs in one basket." This rings true in investing as well. Diversifying your portfolio by spreading investments across different vehicles like stocks, bonds, and real estate minimizes risk.

An undecorated personal story: I once met a colleague, Tom, who invested everything in a single tech stock. When the company faced a downturn, his investment practically vanished. He learned the hard way that diversification could have saved his financial portfolio.

Start Small and Learn As You Go

If you're new to investing, it's okay to start small. Don't let fear of the stock market or economic jargon scare you away. Educate yourself through books, online courses, or talking to experienced investors. Over time, your confidence and portfolio will grow.

Conclusion: Embrace Your Investment Journey

Investing doesn't have to be daunting. With clear goals, a sensible budget, and diversified options, you're well on your way to becoming a savvy investor. What investment strategies have you been curious about?