A Beginner's Guide to Stress-Free Investing with Boglehead Principles

Discover stress-free investing tips using Boglehead principles for better financial wellness.

Hey there, curious reader! Today, I want to chat about something close to my heart — investing the Boglehead way. If you're like me, you've probably felt the stress of financial planning and investing. But what if I told you there's a way to grow your wealth without losing sleep over it? Enter Boglehead principles!

Who Are the Bogleheads?

The Bogleheads community is inspired by John C. Bogle, the founder of The Vanguard Group and creator of the first index fund. They promote simple, low-cost investing strategies focusing on long-term growth. No complex stock-picking or high fees here! The core idea is to invest in index funds and keep things simple.

Why Index Funds?

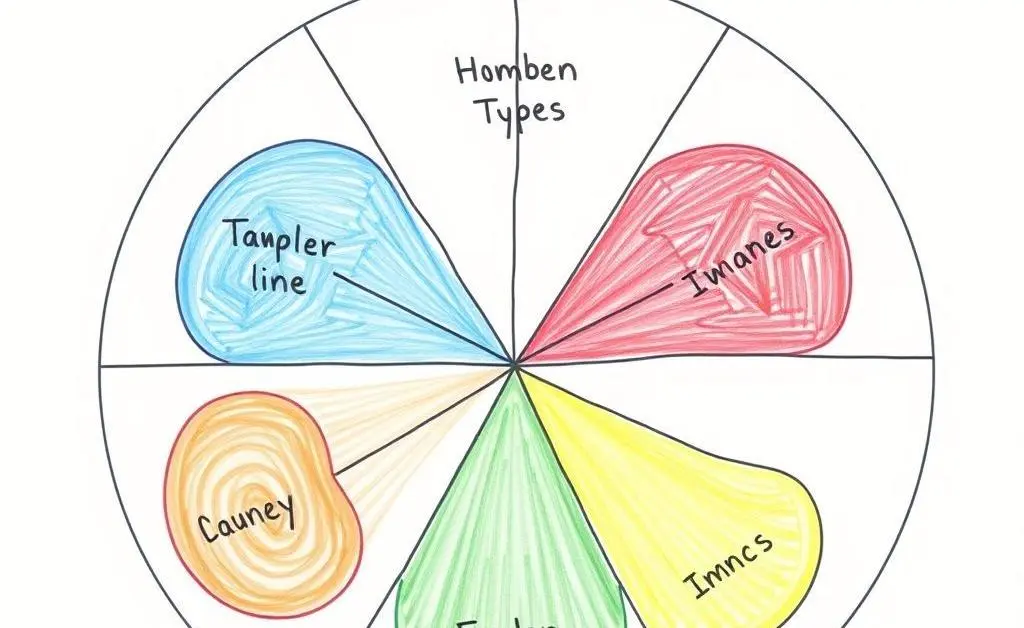

So, why choose index funds? Well, index funds are designed to track a market index, providing broad exposure to various sectors. They offer diversification without the hassle of picking individual stocks. And let's not forget, they typically come with low fees. Picture it like this: instead of betting on specific horses, you're betting on the whole racetrack.

Understanding Expense Ratios

One of the key Boglehead principles is minimizing costs. Expense ratios represent the annual fee that all funds or ETFs charge their shareholders. By choosing low-cost index funds, you save a significant amount over time. As fees decrease, your potential returns increase. Imagine those saved fees as future vacations or cozy retirement mornings!

Setting and Achieving Financial Goals

Before diving into investing, it's crucial to set clear financial goals. Are you saving for retirement, a house, or your child's education? Define these goals clearly, as they will guide your investment strategy and choice of funds. By focusing on your unique financial roadmap, you can align your investments with your life's ambitions.

Keeping It Simple but Effective

The beauty of Boglehead investing lies in its simplicity and effectiveness. A common approach is to split your portfolio between total market index funds, with a mix that suits your risk tolerance and time horizon. Want a balanced life? Combine this approach with healthy habits like exercising and connecting with friends for holistic well-being.

Final Thoughts

The path to financial security needn't be complicated or intimidating. By adopting the Boglehead philosophy of low-cost, diversified, and passive investing, you're setting yourself up for a financial future that aligns with your life goals, minus the stress. What do you think — ready to dip your toes into the world of Boglehead investing?

I'd love to hear your thoughts in the comments below! Feel free to share any questions or personal experiences you have in this journey.