A Gentle Guide to Dividend Investing for Beginners

Start earning passive income with dividends using this beginner-friendly guide.

Have you ever wondered how to start investing and make your money work for you, even while you're chilling on the couch? Welcome to the world of dividend investing, a strategy that's not just for seasoned financial gurus but perfect for beginners too.

What is Dividend Investing?

At its core, dividend investing is buying stocks that pay you back in dividends, a way for companies to distribute a portion of their profits to shareholders. It's like getting a thank-you card with cash in it – delightful, right?

Why Choose Dividend Stocks?

Dividend stocks are attractive because:

- Steady Income: They provide a regular income stream, perfect for funding a little splurge or saving up.

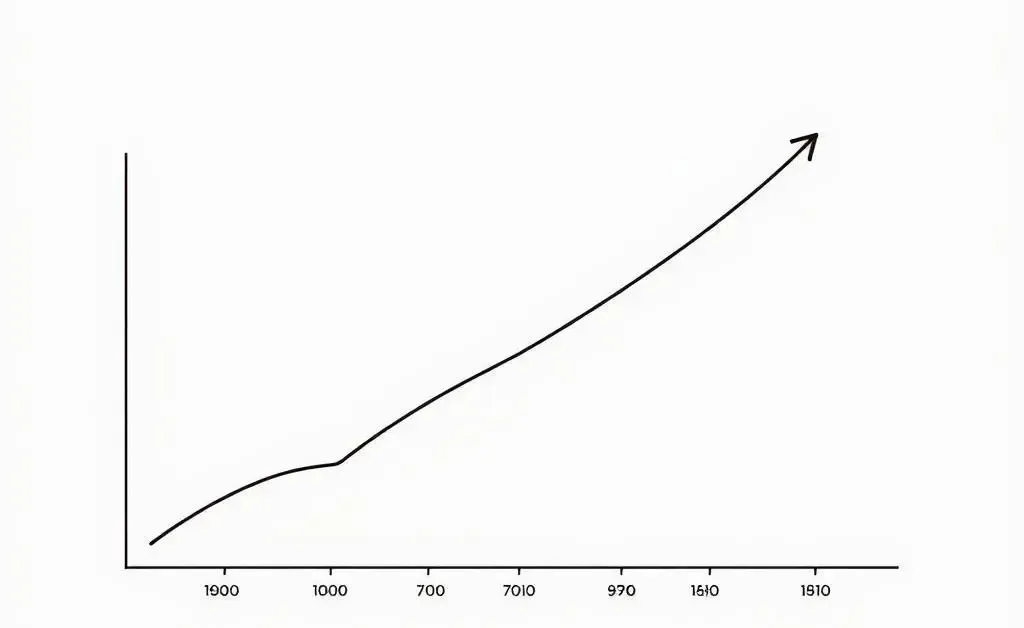

- Potential Growth: If the company's profits increase, so can the dividends.

- Reinvestment Opportunities: Reinvesting dividends can compound your gains over time.

A Relatable Anecdote

Consider my friend Sam, who started dividend investing after inheriting some stock from a great aunt. Nervous at first, Sam soon realized it was just like tending to a small garden. A little attention here and there, and it blossomed into a source of passive income, even allowing for a few unplanned weekend getaways.

Getting Started with Dividend Investing

Starting with dividend investing is less complicated than you might think:

- Research: Look for companies with a consistent track record of paying and increasing dividends.

- Start Small: Begin with a few shares to understand the landscape.

- Reinvest Dividends: Use dividend reinvestment plans (DRIPs) to compound your earnings.

Common Concerns for Beginners

New investors often worry about the risks. Keep in mind:

- Market Fluctuations: Stock prices can rise and fall, but a solid dividend stock often remains resilient.

- High Yields: Be cautious of stocks with overly high yields; they might not be sustainable.

What's Holding You Back?

Diving into the world of dividend investing can feel intimidating, but remember, everyone starts somewhere. Read up, engage with communities, and take baby steps toward financial freedom. What's your next question on this journey?