Achieving Financial Independence: A Personal Journey and Practical Tips

Explore practical steps to financial freedom through budgeting and smart investing.

Have you ever wondered what life would be like if you no longer had to trade your time for money? That’s what financial independence is all about. It’s not just a distant dream; it's an empowering reality that anyone can achieve with the right mindset and strategies.

Getting Started: Understanding Financial Independence

Financial independence, or FI as it's often called, means having enough income to cover your living expenses without needing to work. This concept is more than just about savings; it involves making smart financial decisions and investments to create a sustainable income stream.

Finding Your Why

Before anything else, it's crucial to define your 'why'. Why do you want to be financially independent? Is it to have more time for family, travel, or pursue a passion? Knowing this will help you remain focused and motivated.

Budgeting: The Foundation

Your journey towards financial independence can’t begin without a solid budget. Track your income and expenses meticulously. Tools and apps can simplify this process, but a simple spreadsheet can do wonders. Prioritize needs over wants, and watch your spending habits evolve over time.

Saving and Investing: Building Wealth

Once you’ve got a budget, the next step is to save and invest. Savings should primarily focus on building an emergency fund. Once that's done, you can channel funds into investment vehicles. Investing might seem intimidating at first, but remember that it's a marathon, not a sprint.

Simple Investment Strategies

Start with low-cost index funds which offer diversification and have historically provided steady returns. This doesn’t mean putting all your eggs in one basket. Diversify across asset classes to balance risk and reward.

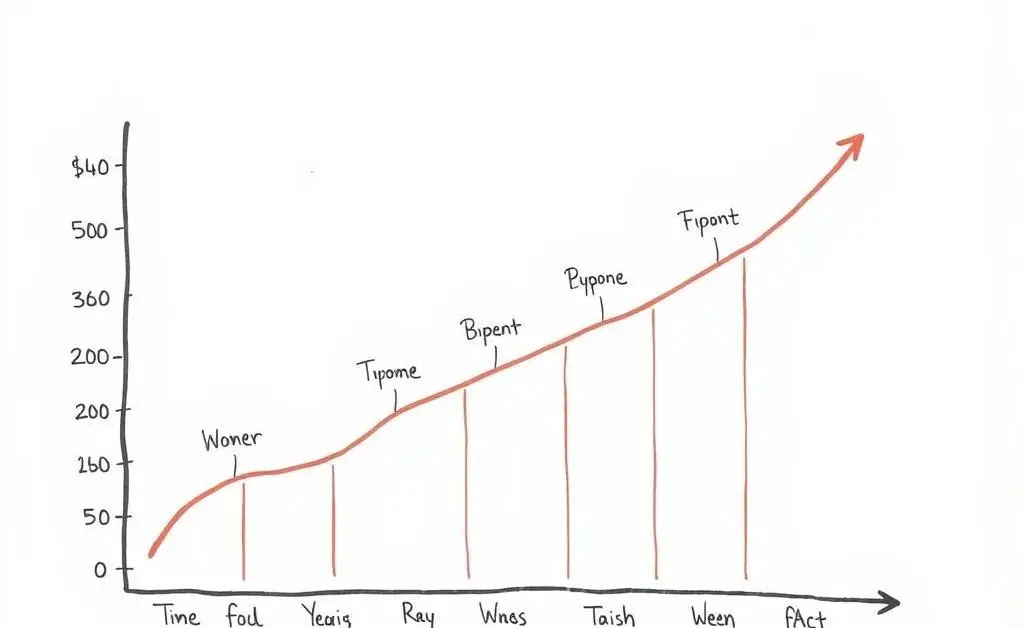

Reaching Milestones and Adjusting Goals

Tracking progress is crucial. Celebrate small victories as you reach savings milestones or reduce debt. This not only boosts morale but also reassures you that you're on the right path. Periodically review your goals and adjust based on life changes or financial situations.

The Role of Confidence in Financial Success

Confidence is key. It’s easy to get swayed by market trends or financial advice overload. Trusting your research and sticking to your plan is crucial. Remember, your financial journey is uniquely yours.

Reflections on Financial Independence

Achieving financial independence is no small feat, but it’s undeniably worth the effort. Imagine waking up each day free from financial worry. It’s not just a dream; it can be your reality. What's your next step towards financial freedom?