Achieving Financial Independence: Navigating the Journey with Confidence

Discover practical steps and emotional insights on the path to financial independence.

Imagine sitting down with a steaming cup of tea, gently savoring each sip while pondering the intriguing notion of financial independence. It’s more than just numbers and spreadsheets; it's a journey, profoundly personal and rewarding. In my own journey, I’ve learned that financial independence is about creating a life that feels rich in experiences and security, without being tethered to financial burdens.

Understanding Financial Independence

At its core, financial independence means having enough income to cover your living expenses without the need for a traditional job. Perhaps you’ve wondered, as I have, about the freedom this brings—not just financially, but emotionally and mentally. It's not about extravagant wealth. Instead, it’s about having the means to live life on your own terms.

Setting Your Path

Getting started on this path can feel daunting—but consider starting small. Begin by taking a clear look at your finances. What are your current spending habits? I’ve found it helpful to sit at my cozy kitchen table, perhaps with a candle flickering, as I sort through my budget. Having a clear picture brings a sense of calm amid the financial whirlwind.

Budgeting with Heart

Budgeting is an emotional and practical exercise. As you sift through your expenditures, make room for what's truly important. What brings joy and value to your life? I realized that a night out with loved ones brought more joy than unexpected, impulsive buys. This simple shift can bolster your financial strategy and emotional satisfaction.

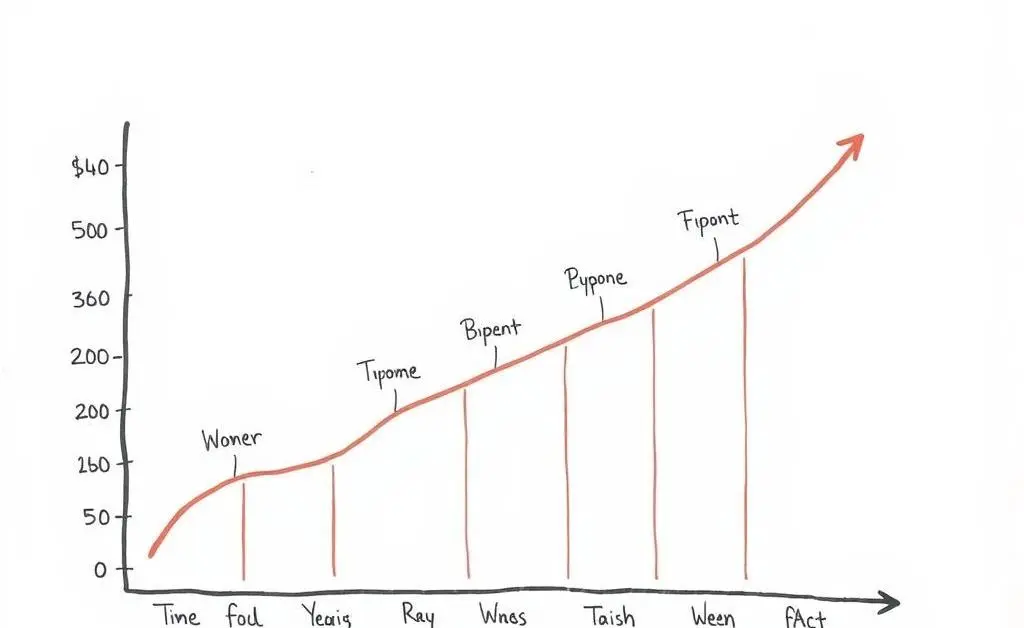

Investing with Confidence

Investing is another step toward financial independence. It’s a way to make your money work for you while you're busy living. But, I understand the hesitation—it can feel like uncharted territory. To boost your confidence, start with research and seek advice from trustworthy sources. Remember, like balancing scales, it’s all about finding the right equilibrium of risk and security.

A Holistic Approach

Moving toward financial independence isn’t just a financial journey; it’s a holistic lifestyle shift. As I’ve learned through experience, it involves emotional resilience and adaptability. Celebrate small milestones along the way; they are the signposts of your progress.

As we continue our journey toward financial independence, remember that each financial decision should align with our values and aspirations. It's a personal journey, after all—one that’s worth every ounce of effort and introspection it demands.

What are your thoughts on financial independence? What steps are you taking to carve your path?