Achieving Financial Independence: Practical Tips for a Secure Future

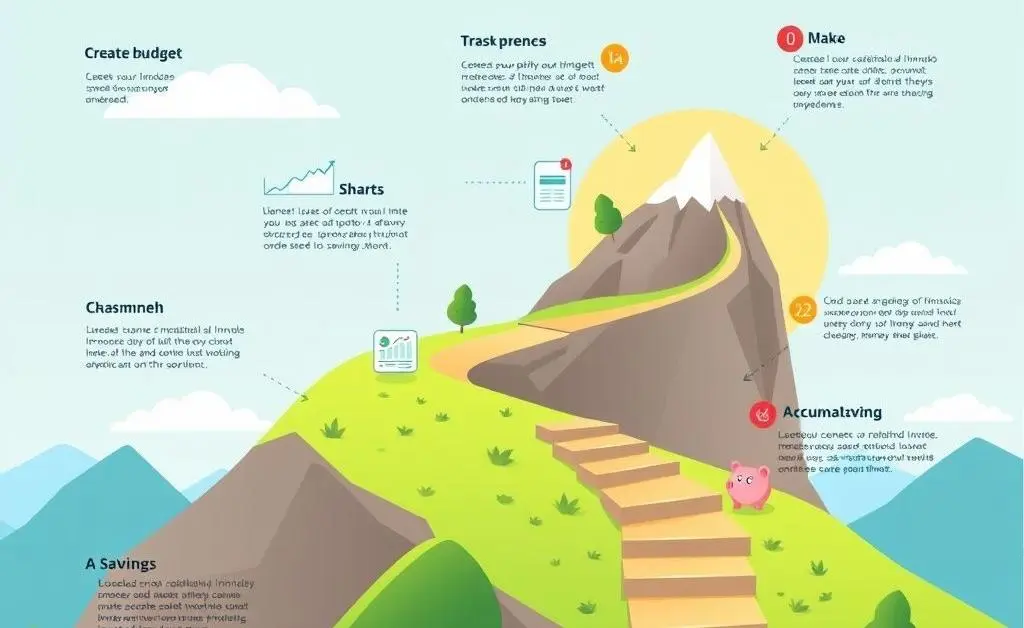

Discover practical tips for achieving financial independence and securing your future without stress.

Hey there! If you've ever wondered how to achieve financial independence and ensure a more secure future, you're not alone. Many of us dream about reaching a point where working is optional, and our finances are no longer a constant source of stress. Today, let's explore some practical tips to help you move towards that goal.

What Is Financial Independence?

In its simplest terms, financial independence means having enough income to cover your living expenses without needing to work actively. Think of it as getting to a spot where your savings and investments generate sufficient returns to live off comfortably. Sounds great, right?

1. Start with a Solid Budget

Creating a budget might sound basic, but it's your first step towards financial independence. A well-planned budget helps you track income and expenses, making it much easier to save and invest. Start by listing all your sources of income, then track your monthly expenses. Remember, the goal is to spend less than you earn!

2. Building a Strong Savings Habit

Once your budget is in place, focus on saving. A good rule of thumb is the 50/30/20 budget. Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt retirement. Over time, those savings will grow into a significant financial cushion.

3. Investing Wisely for the Future

Investing is instrumental in achieving financial independence. The earlier you start, the more time your investments have to grow. Look into diverse investment options like stocks, bonds, or mutual funds. Don't forget to research and seek advice if you're unsure about where to invest.

4. Reducing and Eliminating Debt

Debt can be a major roadblock on your path to financial independence. Prioritize paying off high-interest debts first, like credit card balances, and consider consolidating loans or refinancing to lower your interest rates.

Benefits of Financial Independence

Reaching financial independence offers numerous benefits. You gain the freedom to pursue work that you’re passionate about, or even retire early if you wish. Additionally, you have peace of mind knowing that you can handle financial emergencies without going into debt.

Ready to Take the First Step?

Financial independence is a journey, not a sprint. Start small, stay consistent, and remember that every step you take is a step closer to your goal. What's your next move toward achieving financial independence? Let’s chat about it in the comments!