Achieving Financial Independence: Your Guide to a Secure Future

Discover practical steps to reach financial independence and embrace a future of freedom and security.

Have you ever dreamed of waking up one day, free from the constraints of your 9-5 job, and financially equipped to explore the things you truly love? Welcome to the gateway to financial independence—an empowering concept that promises just that.

What is Financial Independence?

At its core, financial independence means having enough income to cover your living expenses without relying on a traditional job. This could be achieved through savings, investments, or passive income streams. The essence is to have a financial cushion that frees you from the constraints of a paycheck-to-paycheck lifestyle.

Why is Financial Independence Important?

The benefits of financial independence are plentiful. It provides a sense of security and confidence, knowing you are prepared for life’s uncertainties. Having that financial latitude allows you to take career risks, pursue passions, and enjoy a work-life balance that suits you.

Steps to Achieve Financial Independence

Now, you might be wondering how to start this journey. Here are some practical steps:

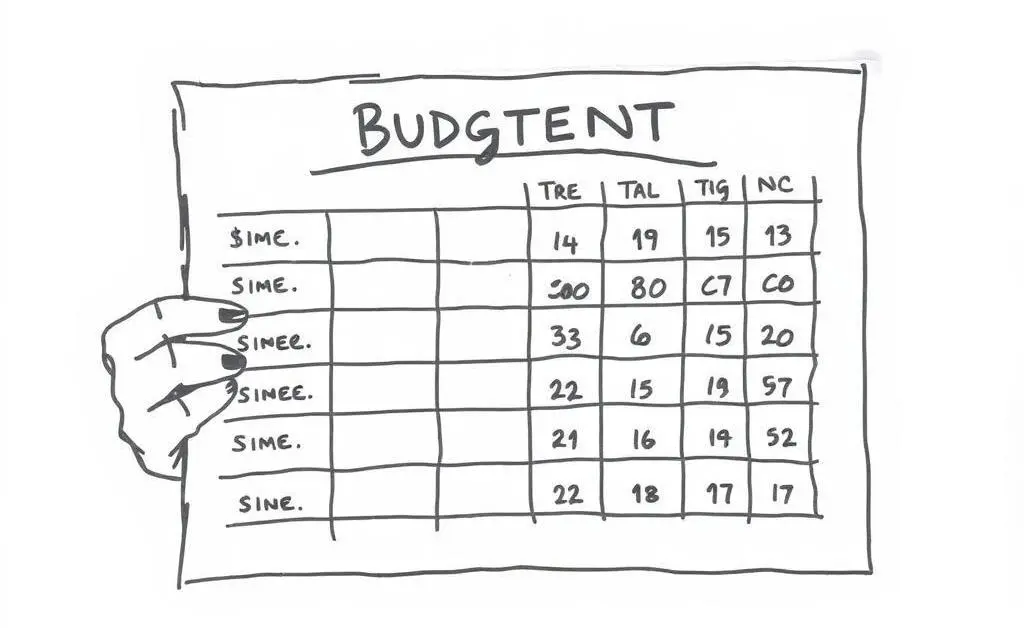

- Budget Wisely: Start by understanding your income and expenses. Create a budget that helps you save and invest regularly. Consider tools like Mint or YNAB to manage your finances effectively.

- Prioritize Saving: Aim to save at least 20% of your income. Automate these savings to make the process seamless and less about willpower.

- Invest Smartly: Learn about investments that can generate passive income. Consider speaking to an advisor or utilizing platforms like Vanguard for informed decisions.

- Reduce Debt: High-interest debts can be a major barrier. Focus on paying off these debts to free up more resources for savings and investments.

Overcoming Common Challenges

No journey is without its obstacles, and financial independence is no exception. Many grapple with unexpected expenses or difficulty sticking to budgets. It helps to anticipate these hurdles and remain adaptable and diligent with your financial plan.

The Freedom Ahead

Financial independence is not about quick fixes; it’s a marathon, not a sprint. But the rewards, both emotional and financial, are worth every effort. Imagine the freedom to decide how to spend your days, pursue your passions, and secure your family’s future.

Are you ready to embark on this journey? Begin with small, manageable steps, and gradually steer your way toward a financially secure and independent future. What’s your first move on this journey going to be? Let's chat in the comments!