Am I Too Aggressive with My Investment Strategy?

Find out if your investment strategy is too aggressive and learn how to balance risk and reward.

Have you ever wondered if your investment strategy is a tad too aggressive? It’s a question I pondered myself as I looked at my portfolio not too long ago. Balancing risk and reward can often feel like walking a tightrope—go too far one way, and you might find yourself in financially precarious waters. Let’s dive into how you can determine if your approach is indeed too aggressive and what you can do about it.

What Does ‘Aggressive Investment Strategy’ Mean?

An aggressive investment strategy typically means you have a high allocation in equities and minimal interest in safer, often lower-yield investments like bonds. It’s great during bull markets when your portfolio could swell like a balloon. But here’s the rub—during down markets, that balloon can deflate just as quickly.

Signs Your Strategy Might Be Too Aggressive

- High Volatility: If your heart skips a beat every time you check your portfolio, your asset allocation may be too risky.

- Lack of Diversification: Putting all your eggs in one basket can leave you exposed to significant market fluctuations.

- Short-Term Focus: If you're more focused on quick gains, you might be steering your strategy aggressively.

How to Find Balance

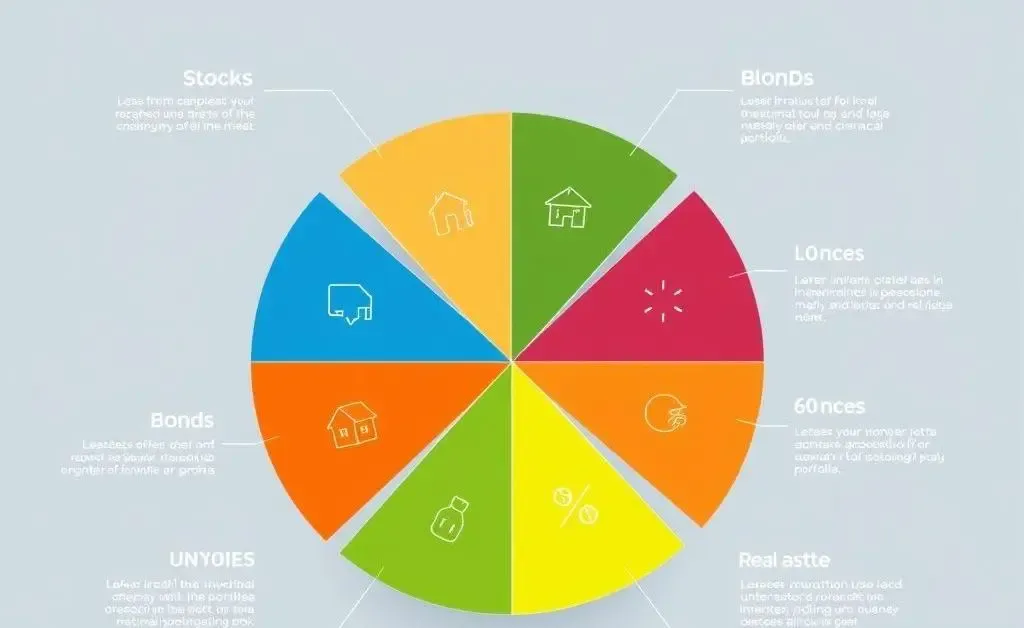

Finding the right balance doesn't always mean playing it safe, but rather tailoring your strategy to match your risk tolerance and financial goals. One way to do this is by embracing diversification. By spreading your bets across different asset classes like bonds, stocks, and real estate, you cushion yourself against market volatility.

Consider Your Financial Goals

Ask yourself what you want to achieve in the short and long term. Are you saving for retirement or a down payment on a house? Your time horizon can significantly impact your risk capacity. For instance, younger investors can often afford to take on more risk as they have more time to recover from potential losses.

Final Thoughts

In the end, it’s all about what suits your life stage and financial goals. Financial decisions don't have to be set in stone and should evolve as your life circumstances change. If you’re feeling a bit anxious about your strategy, don’t hesitate to consult with a financial advisor who can help tailor an approach that feels right for you.

What strategies have you found effective in managing your investment risk? Let's keep the conversation going in the comments below!