Are You Being Paid What You're Worth? Understanding Your Salary In Insurance

Dive into the nuances of insurance salaries with relatable advice and practical tips.

So you’ve found yourself wondering, "Am I earning what I should be in my job?" It’s a relatable concern, especially in the insurance world where compensation can vary as widely as the types of policies handled. From entry-level positions to seasoned agents, understanding whether you're underpaid can feel like navigating a complex policy clause.

How Much Should You Be Earning?

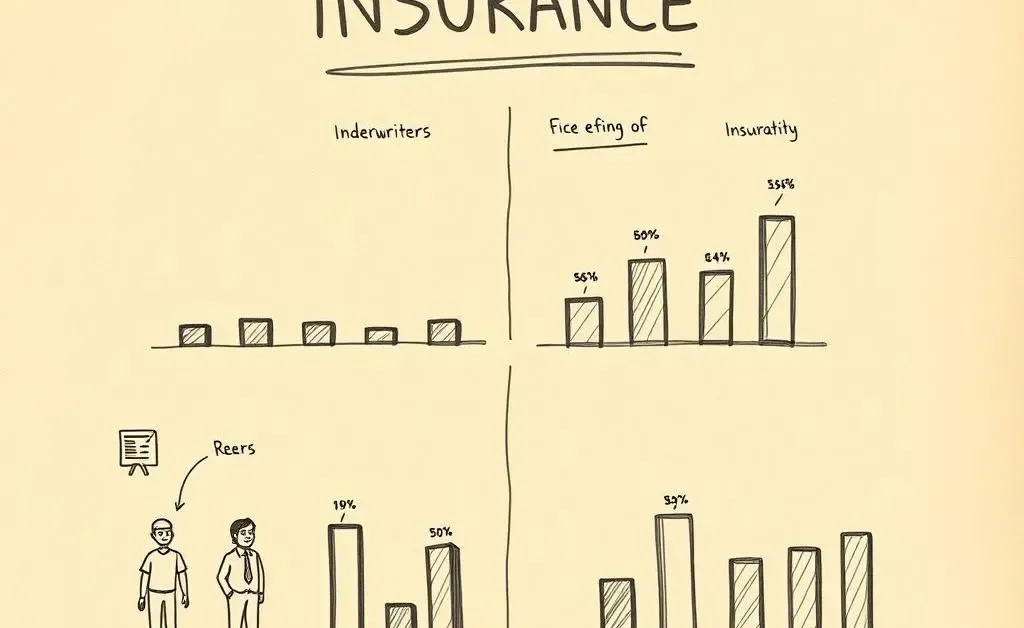

First and foremost, understanding the average salary in your role and location is crucial. Salaries in the insurance industry can differ significantly depending on experience, specialty, and location.

- Entry-level insurance agents might start at around $40,000 annually.

- Experienced underwriters might earn $75,000 to $100,000.

- Specialized roles or those in metropolitan areas might fetch even higher.

Consider these figures as rough gauges and adjust for your unique situation. If you’re working in a high cost of living area, for instance, your salary should reflect that.

Relatable Salary Comparison

Let’s imagine a day in the life of Andy, a mid-career insurance underwriter. Andy's been with his company for five years. He recently discovered that his friend, working the same role but in a different city, earns 10% more. However, Andy’s job offers flexible hours and remote work opportunities—a non-monetary benefit that he loves.

The takeaway? Compensation isn’t just the number on your paycheck. Consider bonuses, work-life balance, and growth potential. If you feel you’re lagging behind, it may be worth negotiating or exploring similar roles that offer better packages.

Steps for Assessing and Acting

If you suspect you’re underpaid, start by conducting a comprehensive salary audit. Check industry reports, speak to colleagues, and use salary comparison tools.

Negotiating for the Salary You Deserve

When you’re ready, prepare to negotiate:

- Back your arguments with data: Have salary statistics at hand.

- Highlight your achievements: Showcase your value to the company.

- Be open to non-monetary compensation: Flexible hours, remote work, or learning opportunities.

Remember, a well-prepared case can significantly enhance your chances of a favorable outcome. After all, who wouldn't want to earn what they're truly worth?

What’s Your Unique Value?

Evaluate your offerings. Do you bring something unique? Whether it’s unmatched client rapport or a knack for complex cases, your distinct skills can sometimes translate into leverage at the negotiating table.

Now, let me ask you—what steps will you take to ensure your salary reflects your true worth in the coming months?