Are You Counting Your Pension Contributions Correctly?

Learn how to effectively include pension contributions in your financial planning.

Hey there! Have you ever stared at your financial statements and wondered if you're on the right track with your pension contributions? You're not alone. Many people grapple with how exactly to account for their Canadian Pension Plan (CPP) contributions and other pension inputs when planning their financial future. Let's dive into how these can be appropriately factored into your financial strategy.

Understanding Pension Contributions

Pension contributions can often be a bit of an enigma in personal finance. Whether you're employed full-time with a company pension plan or contributing to the Canada Pension Plan (CPP), these contributions are crucial components of your financial landscape. But should you view these purely as expenses or as essential investments in your future?

Why Count Pension Contributions?

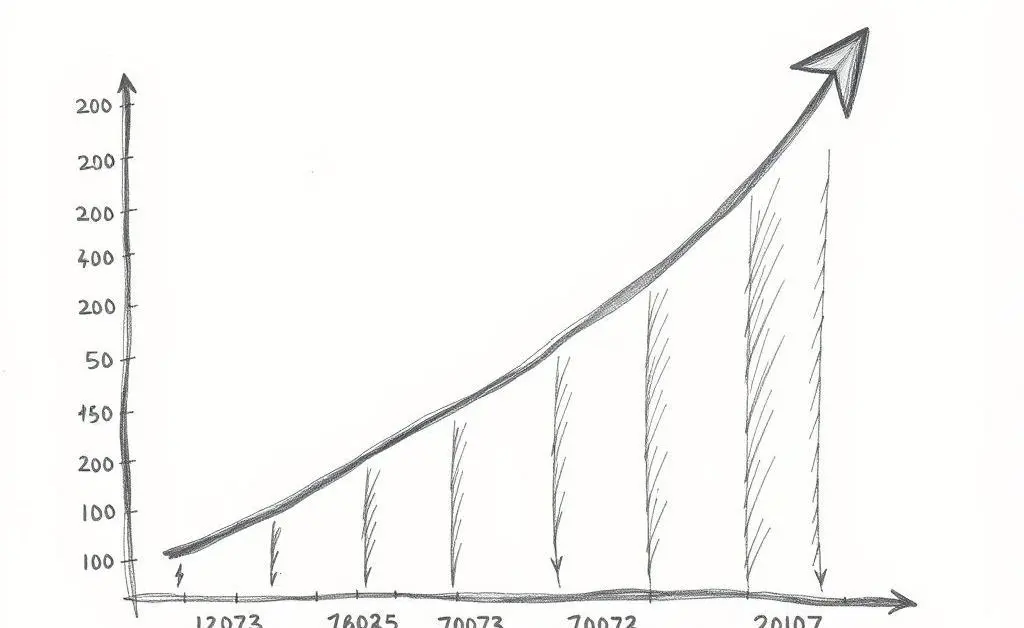

It might be tempting to think of pension contributions as just another deduction from your paycheck. However, viewing them through a different lens can change the game. These contributions are more than expenses; they’re investments in your future stability. By counting them as a part of your investment portfolio, you get a clearer picture of your net worth and future financial health.

Practical Ways to Incorporate Pension Contributions

- Track Contributions: Make sure your contributions are recorded as part of your net worth, giving a full account of your financial growth over time.

- Project Future Benefits: Use online calculators to estimate your future pension income, integrating it into your retirement planning.

- Balancing with Other Investments: Consider how these contributions fit alongside other savings and investments to ensure a balanced approach.

Calculating the Benefits: The Big Picture

Understanding the end benefit of your contributions is key. As you consistently invest in your CPP or company pension plan, this forms a crucial part of your retirement income. It's wise to ask questions like: How much will you realistically receive upon retirement? Will it cover the kind of lifestyle you envision?

Conclusion: Craft Your Roadmap

Incorporating pension contributions into your financial planning isn't just about numbers—it's about crafting the roadmap to your ideal future. So take the time to account for these 'invisible' finances, and utilize the benefits they offer strategically.

Reflect on your current financial approach: Are you already factoring these into your plan, or is it time to change your perspective? As always, a solid plan today is the key to a secure tomorrow.

If you have any personal insights or stories about how you manage your pension contributions, I'd love to hear them! Let's keep the conversation going in the comments.