Beginner's Guide to ETF Investing: How to Start and What to Know

Unlock the potential of ETF investing with practical tips and friendly advice.

Let's face it, jumping into the world of investing can feel like stepping into a dense forest without a map. One of the paths that many successful investors talk about is ETF investing. But what exactly is an ETF, and why should you consider adding them to your portfolio?

What Are ETFs and Why Are They Popular?

ETFs, or Exchange-Traded Funds, are like a collection of the best fruits from different trees in the financial orchard. They let you buy into multiple stocks or bonds with a single purchase, making them a cost-effective way to diversify your investments. Launched in the early 90s, ETFs have gained immense popularity as they offer a more accessible entry point into the market compared to individual stocks.

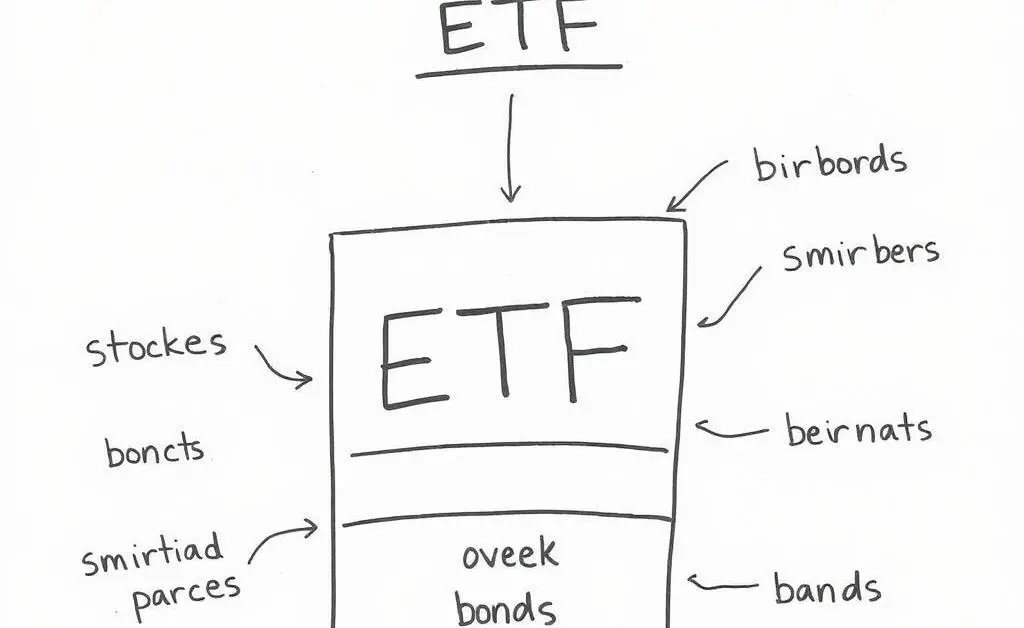

How Do ETFs Work?

Think of an ETF as a basket filled with various investments, which could include stocks, bonds, or other assets. When you invest in an ETF, you're buying shares of this basket. This means with just one purchase, you are spreading your investment across multiple sectors and companies, which helps reduce the risk involved.

Why Consider ETFs Over Individual Stocks?

For beginners, ETFs are often recommended over individual stocks for a few reasons:

- Diversification: ETFs provide instant diversification, reducing the overall risk of your portfolio.

- Cost-Effective: They tend to have lower fees compared to mutual funds.

- Easy to Trade: Just like stocks, ETFs can be traded on major exchanges whenever the market is open.

Steps to Start Your ETF Investment Journey

Ready to dive in? Here are some easy steps to begin:

- Educate Yourself: Familiarize yourself with the ETF world. Understand the different types available like stock ETFs, bond ETFs, and so forth.

- Choose an Online Broker: Look for one that offers a wide range of ETF options and has low fees and commissions.

- Set Clear Objectives: Decide what your investment goals are—be it growth, income, or asset preservation.

- Start Small: It’s okay to start with a modest amount. Gradually increase your investment as you gain confidence.

Final Thoughts

ETF investing could be your ticket to simplifying the investment process, especially if you're a beginner. With a clearer understanding and a more focused strategy, you could make ETFs a core part of your financial toolkit.

Have you started investing in ETFs yet, or is there something holding you back? Let’s chat about it!