Bogleheads Investing: Simplicity Meets Strategy

Explore Bogleheads investing: simplicity, strategy, and smart choices for your financial future.

Hey there! If you're like me, balancing a desire for financial growth with maintaining a relatively stress-free life, you might find yourself drawn to Bogleheads investing. Let’s dive in and see what this approach is all about!

What is Bogleheads Investing?

Bogleheads investing is a strategy based on the principles of simplicity and long-term growth, inspired by the teachings of John C. Bogle, the founder of Vanguard Group. The primary goal is to invest in broad-market index funds, aiming for steady returns through diversification and low costs.

Why Choose Bogleheads Investing?

First and foremost: simplicity. The Bogleheads approach takes the guesswork out of investing. Instead of trying to pick individual stocks, you’re investing in index funds that track the entire market or specific segments of it.

- Low Costs: By focusing on index funds, you minimize fees and maximize your investment returns.

- Diversification: Spreading out your investments reduces risk and increases stability.

- Long-term Focus: This strategy encourages you to look at the big picture rather than getting caught up in short-term market fluctuations.

Key Principles of Bogleheads Investing

The Bogleheads strategy rests on a few core principles that guide investment decisions.

1. Keep it Simple

By investing in broad-market index funds, you ensure that your portfolio is diversified across a wide range of industries and sectors, reducing individual risks and aligning your investments with overall market performance.

2. Focus on Costs

The goal is to minimize costs, as lower expenses mean higher returns for you. Funds with low expense ratios help retain more earnings over time.

3. Stay the Course

Investments can be emotional, but Bogleheads emphasizes sticking with your plan regardless of market fluctuations, riding out ups and downs with discipline.

Getting Started

Starting with Bogleheads investing doesn’t require a massive financial commitment. It’s about commitment to the mindset over time.

Check out the thorough guidelines available from Bogleheads wiki to explore further!

Setting a Financial Goal

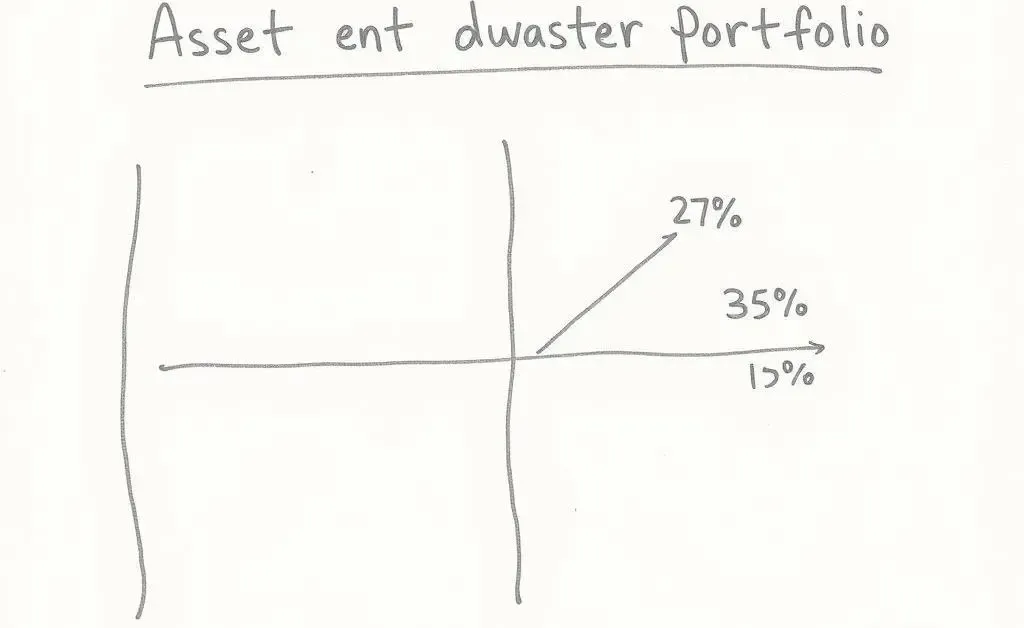

Identify your financial goals and risk tolerance. This will instruct your asset allocation decisions and make sure you match your investment strategy with your financial aspirations.

Final Thoughts

Diving into the world of Bogleheads may just offer the peace of mind you’ve been seeking in your financial journey. With its emphasis on simplicity, low costs, and long-term planning, it leaves room for a more relaxed investment experience.

So, what are your thoughts on indexing and the Bogleheads way? Share them with me in the comments below. Let’s learn and grow together!