Boosting Your Financial Life: The Smart Way to Diversify with Dividend Stocks

Discover how dividend stocks can enhance your portfolio with consistent returns.

Have you ever wondered if there's a way to make your money work for you while you sleep? Well, there just might be—through dividend stocks. Let's dive into how these can be a powerful tool in your investment arsenal.

What Are Dividend Stocks?

Dividend stocks are shares in companies that return a portion of their earnings to shareholders on a regular basis. It's like getting interest on a savings account, but with a bit more excitement. And who doesn't love the idea of getting paid for holding onto something you believe in?

The Appeal of Dividend Stocks

One of the most attractive aspects of dividend stocks is their potential to provide a consistent income stream. Imagine receiving a little thank you gift several times a year just for holding onto your shares. Plus, investing in dividend stocks allows you to benefit from the growth of the company.

- Regular income: Quarterly or monthly payments.

- Potential for capital appreciation.

- Tax advantages in some regions.

- Reinvestment potential: You can choose to reinvest dividends.

Getting Started with Dividend Stocks

Diving into the world of dividends can seem daunting, but it doesn't have to be. Here’s a quick anecdote: a good friend of mine started by investing small amounts in well-known companies known for their reliable dividends, like those in the consumer goods sector. Over time, she gradually expanded to other sectors like tech and healthcare. Her strategy was simple yet effective: diversify and keep track of the incoming dividends.

Steps to Begin Your Dividend Investment Journey

Here’s a practical starting guide:

- Research: Look into companies with a history of dividend payments.

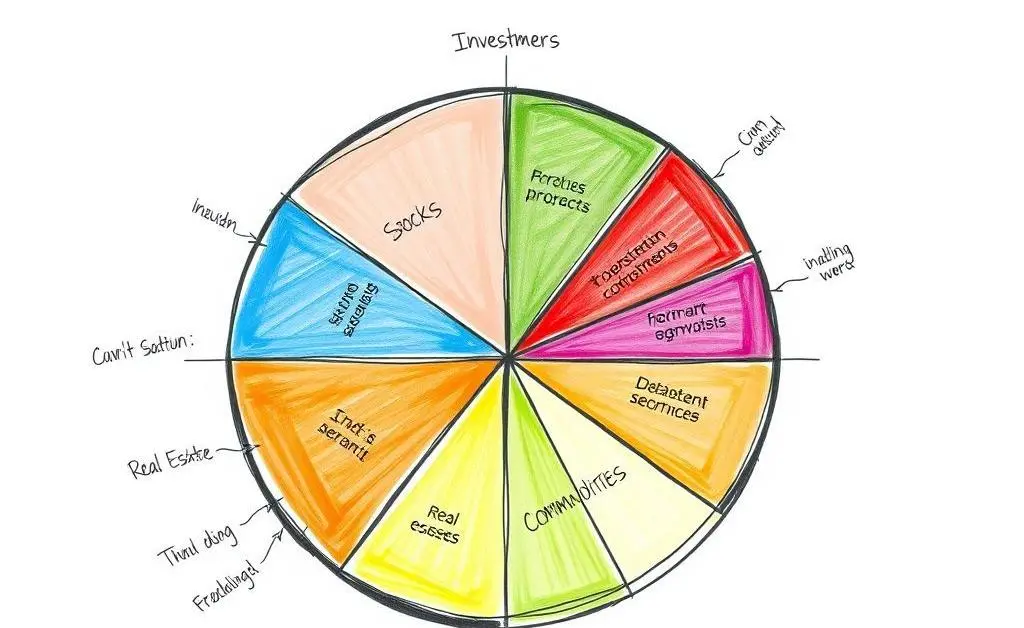

- Diversify: Spread your investments across different sectors.

- Set Goals: Determine what you want from your dividends, like reinvestment for growth or income.

- Monitor: Keep an eye on your investments and market conditions.

Conclusion: A Growth Opportunity Awaits

While investing in dividend stocks isn't without risks, it offers a rewarding opportunity for portfolio diversification and steady income. Have you started considering which companies you'd trust to grow alongside your financial goals?