Building a Balanced Investment Portfolio: A Beginner's Guide

Discover practical tips to create a diversified investment portfolio fostering long-term financial growth.

Have you ever wondered how to build a balanced investment portfolio that caters to your financial goals? Maybe you picture complex charts or endless spreadsheets, but developing a smart investment strategy doesn't have to be daunting.

Understanding Diversification

Diversification is your best friend when it comes to mitigating risks. Imagine it as throwing a diversified party. If one dish is a total flop, your guests can still enjoy the others. In investing, this means spreading your investments across various asset types to reduce potential losses.

Key Benefits of Diversifying Your Portfolio

- Risk Reduction: By not putting all your eggs in one basket, you're less affected by a single investment's downfall.

- Potential for Growth: Diverse assets have the potential to earn returns even if some sectors are down.

- Peace of Mind: A varied portfolio can offer a sense of stability, reducing the stress of market changes.

Selecting the Right Investments

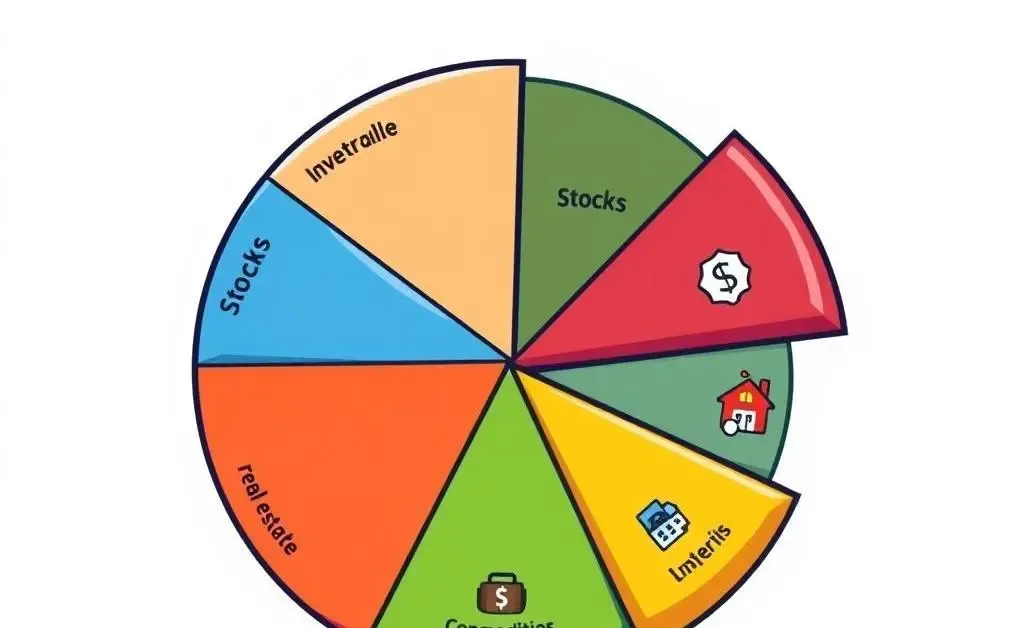

Let's say, for instance, your cousin Joey once poured all his savings into a single tech stock. Although it worked out because he got lucky, it's generally more prudent to consider mixing different asset categories like stocks, bonds, real estate, or mutual funds.

Components to Consider

- Stocks: Offer high potential returns but come with volatility.

- Bonds: Generally more stable, providing regular interest income.

- Real Estate: Valuable for appreciation and rental income.

- Mutual Funds: Convenient diversification through pooled assets.

Regular Assessment

Creating a portfolio isn't a 'set it and forget it' strategy. Just like a garden needs weeding and watering, your portfolio needs regular check-ins. Are your allocations still aligned with your financial objectives?

Rebalancing Your Portfolio

Shifts in the market might throw your asset allocations out of whack. Regular rebalancing helps bring your portfolio back to its original or intended asset weighting.

Conclusion: Your Investment Journey

A successful investment portfolio is a journey and, like all good journeys, it involves smart planning and navigation. Considering diversification, selecting the right investments, and regular assessment are essential to fostering long-term financial growth.

Do you have any tips or personal checklists when evaluating your investment portfolio? I'd love to hear them!