Building a Balanced Investment Portfolio: Insights for Smart Stock Picks

Learn how to create a balanced investment portfolio with actionable insights and practical tips.

Ever found yourself gazing at your collection of stocks and wondering if it truly reflects your financial goals? You're not alone. Many of us venture into the world of investing, often with more enthusiasm than strategy. The key to successful investing is, ironically, not just picking the right stocks but creating a balanced investment portfolio that aligns with your goals. Let's dive into how you can start doing that today.

Understanding Your Investment Goals

Before you can build a balanced portfolio, it helps to know what you want to achieve. Are you saving for retirement, a dream home, or simply aiming to grow your wealth over time? Identifying your objectives helps you tailor your investment strategy accordingly.

Setting Clear Objectives

Your objectives will guide the types of investments you choose. For instance, aggressive growth could lead to more stocks, while preparing for retirement might involve safer bonds. Write down your goals and be specific. The clearer you are, the easier it will be to determine the appropriate risk level for your investments.

The Balance of Risk and Reward

Once your goals are set, it's time to balance the risk and reward. Investing isn't without its challenges, and each choice carries its own set of risks and potential rewards.

Assessing Your Risk Tolerance

Not everyone has the same risk tolerance. Some of us can handle the occasional drop in our portfolio with ease, while others might lose sleep over it. Assess your comfort level with market fluctuations and use this self-awareness to guide your investment choices.

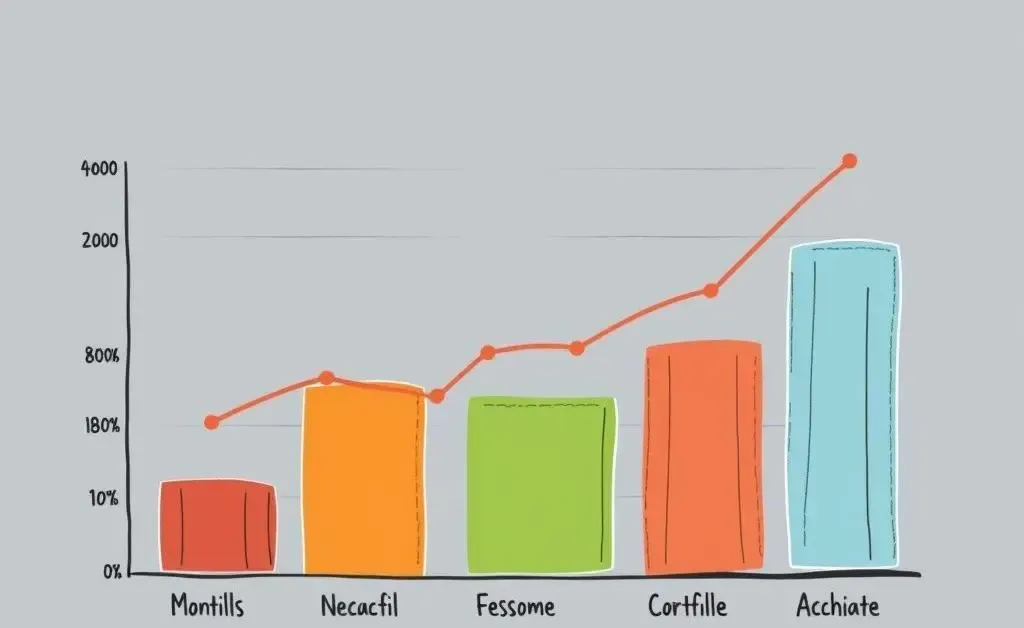

Creating a Diverse Portfolio

Diversification is like having a financial safety net. Instead of putting all your eggs in one basket, spread your investments across different asset types. This can help mitigate risk and increase the potential for returns.

Consider Various Asset Classes

A balanced portfolio might include a mix of stocks, bonds, and possibly alternative assets like real estate or even cryptocurrencies. Each asset class has its own behavior and role in your strategy, which can stabilize your portfolio's overall performance.

Monitoring and Rebalancing

Creating a portfolio isn't a one-time task. Markets change, as do your financial needs and goals. It's crucial to revisit and rebalance your portfolio regularly. This might mean selling off certain assets or buying more of others to maintain your desired level of risk and return.

Conclusion: Taking the First Step

Building a balanced investment portfolio is less about timing the market and more about aligning with your life goals. Take the time to explore what truly matters financially, and tailor your investments accordingly. Remember, the journey to financial growth is a marathon, not a sprint. What steps will you take today to start building your balanced portfolio?