Building Confidence in Your Financial Journey: Simple Steps for Success

Explore practical ways to boost financial confidence and make informed decisions.

Introduction: The Personal Side of Finance

Have you ever felt overwhelmed at the thought of making big financial decisions? You're definitely not alone. Many of us find ourselves at crossroads when it comes to budgeting, saving, and investing. But what if we could tackle these challenges with a little more confidence? Let’s chat about how we can approach our finances with clarity and small, manageable steps.

Understanding Your Financial Starting Point

Before we can move forward, we need to understand where we are right now. This includes taking a look at your current budget and spending habits. A simple approach is to track your expenses for a month using a notebook or an app on your phone. It might surprise you to see where your money is really going.

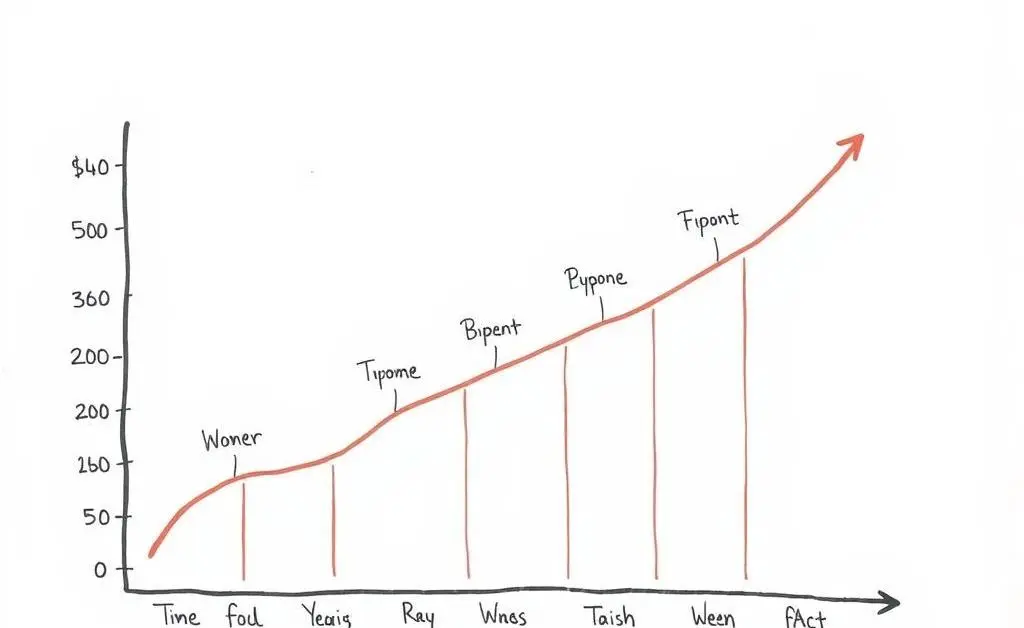

Establishing Financial Milestones

Once you have a clear view of your finances, it's time to set meaningful goals. Think of these as small milestones on your financial journey. Maybe you want to pay off a credit card, save for a big trip, or start contributing more toward your retirement. Each goal should feel like a natural progression of your current situation.

The Joy of Budgeting: Finding Balance

Budgeting isn't just about cutting back; it's about helping you make purposeful choices. Start by categorizing your expenses into needs, wants, and savings. Needs might include rent and groceries, while wants might be dining out or entertainment. Don’t forget to allocate part of your budget for savings to ensure you're building a buffer for the future.

Creating a Comforting Environment for Financial Decisions

Sometimes, setting the right mood can make budgeting more enjoyable. Pick a cozy spot at home, maybe with some warm lighting or your favorite tea. This can help transform budgeting into something calming rather than a chore.

Making Confident Investment Choices

Investing can initially seem overwhelming, but it doesn’t have to be. Start small by exploring low-risk options like index funds or bonds, which provide a relatively stable return with less volatility. As you grow more comfortable, consider diversifying your portfolio with other types of investments.

The Power of Knowledge

Education is key. Read articles, listen to podcasts, or even take an online course to broaden your understanding of your investment options. The more you know, the more confident you'll feel to make decisions that align with your goals.

Conclusion: A Reflective Journey

Financial confidence doesn’t happen overnight, but with each step forward, you're paving the way towards a more secure and empowered future. Remember that every financial journey is unique, and the most important thing is to stay true to your values and aspirations. What’s your next step in your financial adventure?