Building Core Holdings for Your Roth IRA: A Friendly Guide

Curious about core holdings for your Roth IRA? Discover tips, strategies, and more with our practical guide.

What's Inside Your Roth IRA?

Have you ever wondered what core holdings should make up your Roth IRA? If the idea of choosing the best investments seems daunting, you're not alone. Many people grapple with this decision, seeking a balance between risk and return for a comfortable retirement. In this post, we'll explore how to create a robust foundation for your Roth IRA, so you can invest with more confidence.

Understanding Your Investment Options

Your Roth IRA can host a variety of investment options, providing a playground of choices to secure your golden years. Common choices include:

- Stocks: Owning shares in individual companies.

- Bonds: Lending money to issuers with the promise of returns.

- Mutual Funds: Selecting funds managed by professionals to diversify your investments.

- Index Funds: Buying funds tracking specific market indices.

Choosing among these isn’t just about preference but aligning your choices with your financial goals and risk tolerance.

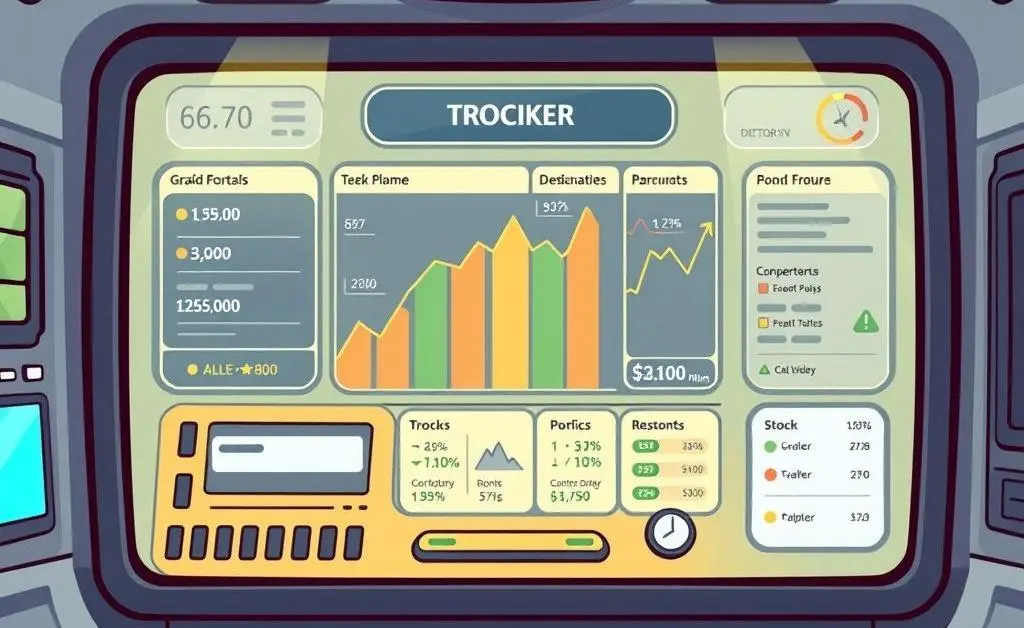

The Magic of Diversification

Meet Alex, a curious investor. Alex used to invest solely in tech stocks with dreams of quick gains. However, a market downturn led to some sleepless nights. Realizing the importance of diversification, Alex decided to spread investments across different sectors and asset types, cushioning the blow during turbulent times.

Diversification involves mixing various asset classes to reduce risk. Think of it as a safety net you never knew you needed. By balancing stocks, bonds, and other investment vehicles, you can help ensure a smoother ride toward retirement.

Identify Your Winning Strategy

Every investor has unique objectives. Crafting your strategy might include aggressive growth for the young or stable income streams as retirement looms closer. Keeping this in mind helps you align your core holdings with your desired outcomes.

Moving Forward with Confidence

Making savvy investment decisions for your Roth IRA can set you on the path to financial freedom. The goal isn’t to imitate the latest trends but to secure a portfolio that reflects your aspirations and uncertainties. So, what does the future hold for your retirement savings? How will you grow your wealth while securing peace of mind?

Share your thoughts in the comments below. Let's learn from each other's journeys!