Building Financial Confidence: A Journey to Practical Money Habits

Discover practical money habits to boost financial confidence one step at a time.

Have you ever found yourself staring at your financial statements, overwhelmed and unsure of where to start? You're not alone. Many of us feel that way at times, especially when attempting to navigate the vast sea of personal finance. But don’t worry, because building financial confidence is very much a journey — one that’s both achievable and rewarding.

Understanding Financial Habits

Before anything else, let’s talk about habits. Our financial habits shape how we approach money daily. These include saving, spending, and investing behaviors we've picked up, often subconsciously. By reassessing these habits, we open up pathways to develop better money management skills.

Start by jotting down your current financial practices. Are you someone who tends to save a little from each paycheck or do you prefer spending on experiences? There's no right or wrong answer, but recognizing patterns is essential.

Setting Realistic Financial Goals

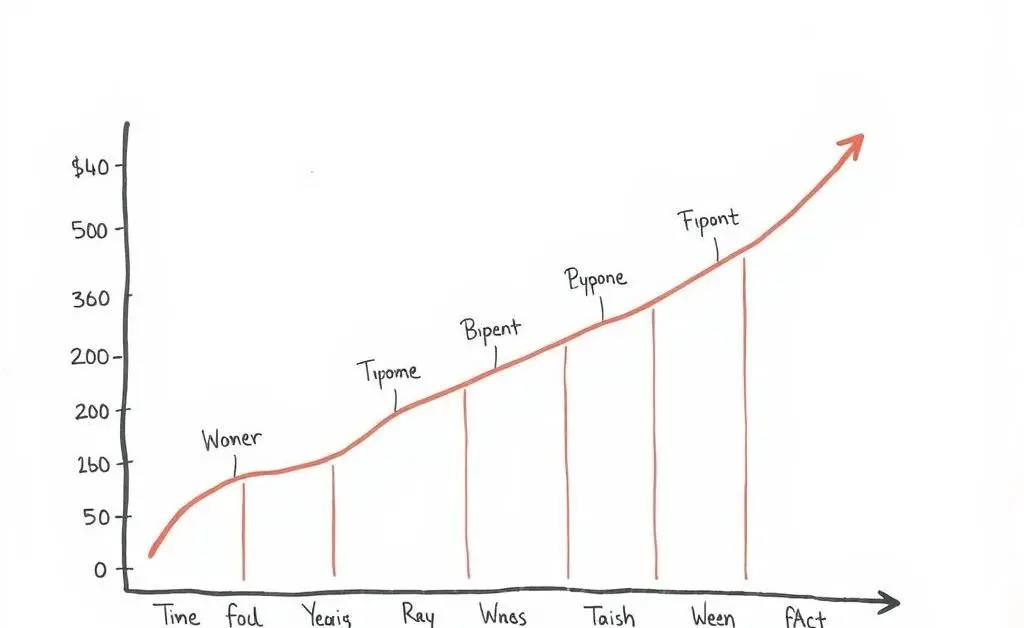

Once you’ve identified your habits, it's time to set goals. Creating realistic and personal financial milestones is crucial. Think about short-term targets like building an emergency fund, and long-term objectives such as buying a home or planning a dream vacation.

Use tools like spreadsheets or budgeting apps to map out these goals. Remember, the best goals are specific, measurable, and, importantly, achievable. This way, you can track your progress and keep yourself motivated.

Budgeting: Your Money's Best Friend

If you're looking to take control, budgeting should be your next step. Though it may sound intimidating, budgeting is simply creating a plan for your money. Start small. List your income sources and monthly expenditures, dividing them into essential and non-essential categories.

Tools like budgeting apps can make this process smoother. You could even turn this into a weekly ritual, perhaps with soothing tea and soft music to turn budgeting into a moment of self-care.

Investing in Yourself

We can't talk about financial confidence without mentioning investments. While investing can seem daunting, remember it’s an investment in your future. Start by understanding the basics and gradually easing into options that align with your risk tolerance and goals.

Ensure you're equipped with the right knowledge — whether through online courses or financial advisory services. Resources like investing guides can be a great starting point. Remember, it's all about taking one confident step at a time.

Conclusion: Your Path to Financial Confidence

Developing financial confidence isn’t about having all the answers but about embracing curiosity and taking steps that fit your life. It’s a personal journey — yours alone — and each financial choice is a step closer to the peace of mind and freedom you seek.

So, as you sip on your favorite tea, take a moment to appreciate every small victory in your journey towards financial empowerment. Here’s to building a relationship with money that’s as warm and supportive as a conversation with a good friend.