Building Financial Confidence: A Personal Journey into Budgeting and Smart Investments

Discover how boosting your financial confidence can transform your budgeting and investment journey.

Hey there! Let’s talk about something we all want but sometimes feel elusive: financial confidence. It’s that inner peace when you know your money works for you, and it starts with two fundamental practices—budgeting and investing smartly.

Understanding Your Financial Landscape

When I started my financial journey, 'financial confidence' was just a buzzword. But as I dug deeper, it transformed into a tangible goal. The first step was understanding my financial landscape. I needed to know where my money was going each month. Sounds simple, right? Yet, money often slipped through my fingers on small, unnecessary things.

Setting aside a cozy space for budgeting—light candles, make a cup of tea—can transform a daunting task into a comforting ritual. It’s about creating an environment where you’re at ease to make financial decisions.

Crafting a Personalized Budget

Once you understand your spending habits, crafting a budget comes next. Budgeting isn’t about restrictions; it’s about understanding your priorities. Imagine it as a roadmap guiding you toward your financial goals. I use a simple spreadsheet that tracks my income and expenditures—dividing needs, wants, and savings. Trust me, once you incorporate savings as a 'fixed' expense, your future self will thank you!

Sticking to Your Budget

The key to sticking to a budget? Flexibility. Life is unpredictable; your budget should be, too. Some months are tougher than others, and that’s okay. Adjust with grace, and return to your plan when you can.

Building Investing Confidence

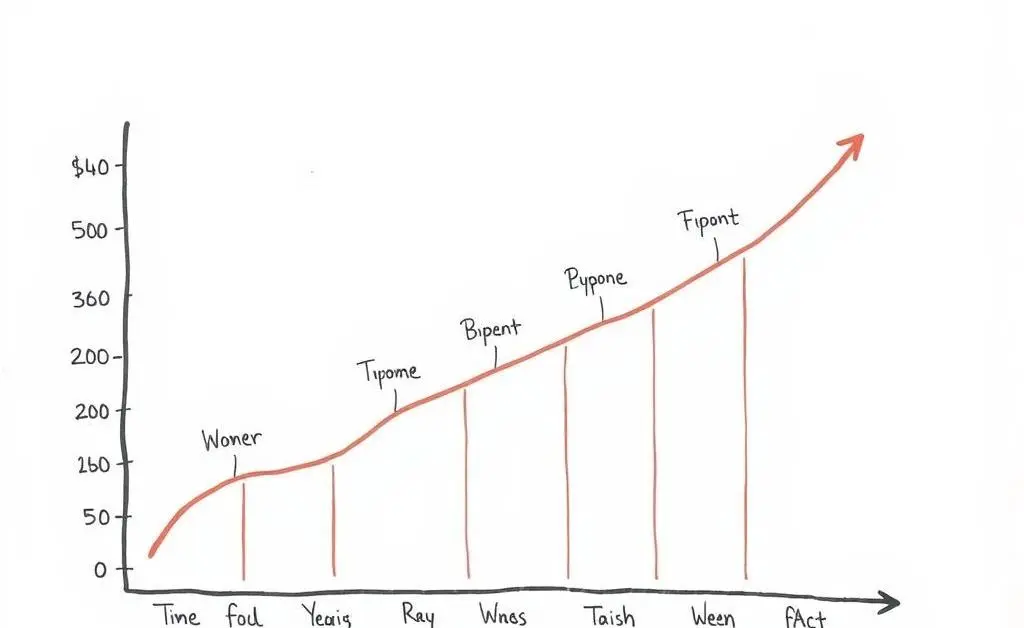

After budgeting, investing was a daunting next step. The idea of growing money sounds enticing but can be intimidating without knowledge. I realized starting small was better than not starting at all.

I began with diversified index funds, low-risk and manageable. Gradually, as I educated myself, I explored more options, like individual stocks. Remember, confidence in investing grows over time, and it’s perfectly okay to ask questions and seek advice.

Key Takeaways

Financial confidence doesn’t appear overnight. It's built with each budget adjusted and every investment considered. Approach each step with curiosity and patience. How about you? What are your tips or experiences for building financial confidence?