Building the Perfect Investment Portfolio: Tips and Insights

Discover practical tips for building a strong investment portfolio today.

Hey there, friends. Are you diving into the world of investments and trying to figure out how to build a solid portfolio? You’re not alone. Investing can sometimes feel like solving a puzzle where every piece matters, and today, I'm here to help you put those pieces together.

Understanding the Basics of an Investment Portfolio

Let’s start with the basics: an investment portfolio is simply a collection of financial assets that you've chosen, hoping they will work together to meet your financial goals. A well-rounded portfolio often includes a mix of asset classes like stocks, bonds, real estate, and perhaps some cash or commodities. Diversifying your portfolio can help spread risk—something that's key for both beginners and seasoned investors.

Why Diversification Matters

Imagine having all your eggs in one basket—sound risky, right? The same concept applies to investing. By diversifying, you ensure that a poor performance by one investment doesn't doom your entire portfolio. Diversification can help manage risk and improve the odds of achieving more stable returns over time.

Steps to Building a Strong Investment Portfolio

Ready to build? Here are a few steps that can guide you to assemble a robust portfolio:

- Determine Your Goals: What's the end game? Maybe you’re saving for retirement, a home, or your child's education. Having a clear goal defines your investment strategy.

- Assess Your Risk Tolerance: Are you willing to take risks for potentially higher returns, or would you prefer safer investments that tend to grow slowly but surely?

- Research Asset Classes: Each asset class—stocks, bonds, real estate, etc.—performs differently. Learn how they work and what fits into your broader financial plan.

Monitoring and Rebalancing

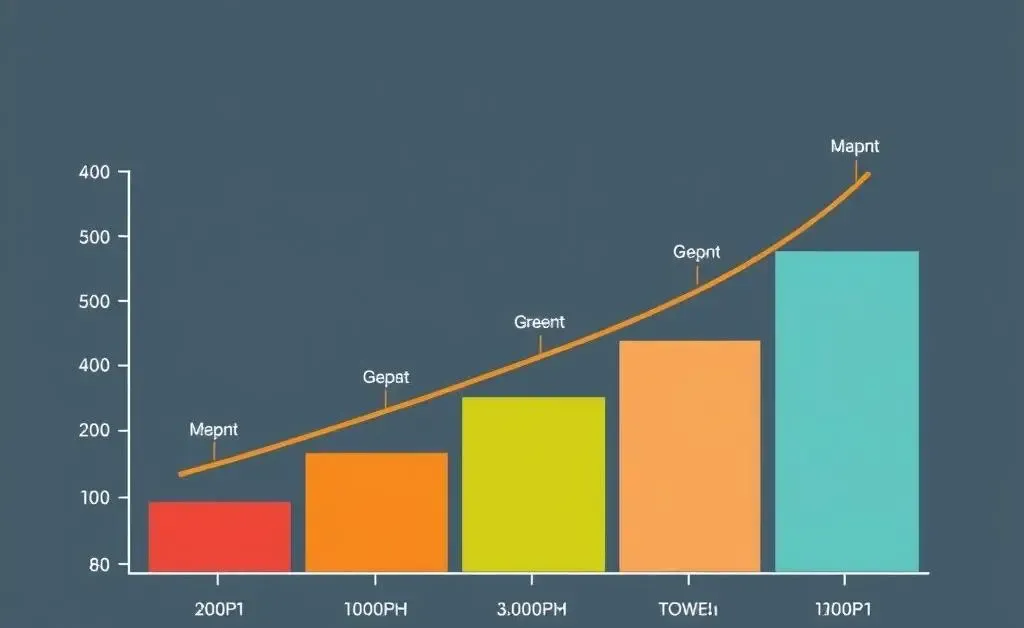

Once you have your portfolio set up, it’s crucial to monitor its performance and rebalance it periodically. Financial markets change, and so should your portfolio. Rebalancing helps realign your asset allocation with your original goals.

Long-term Growth and Patience

Investing is a marathon, not a sprint. The key to building a successful portfolio is patience and discipline. Over time, consistent contributions and strategic adjustments can significantly impact your financial future.

Wrapping up, building the perfect investment portfolio is an ongoing process. Stay informed, adapt to changes, and most importantly, remain committed to your financial goals. So, what strategies will you explore as you build or revise your investment portfolio?