Building Wealth by 30: Tips for Young Investors

Learn how to achieve financial independence by your 30s with these smart investing tips and budget strategies.

Ever wonder what it takes to reach a net worth of $1 million by 30? Well, it's not just a dream for unicorns or the exceptionally lucky. With the right strategies, you too can be on your way to financial independence at a young age. Let’s dive deep into practical methods that can help you achieve this goal.

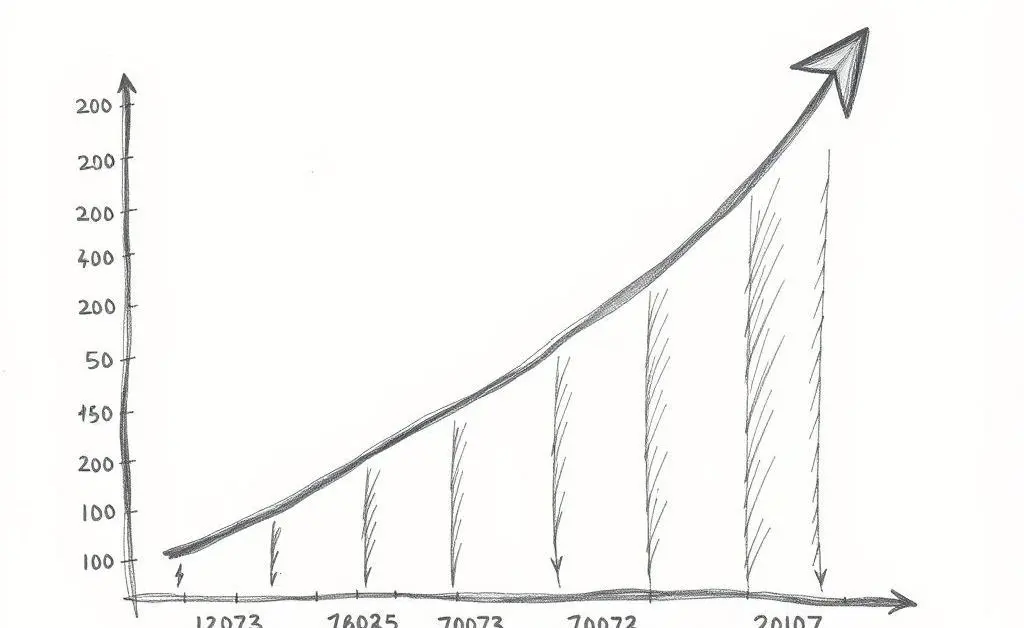

Why Investing Early Matters

Starting young has its perks, especially when it comes to investing. The earlier you dive into the world of investments, the more time your money has to grow. Imagine planting a tree; the sooner it’s in the ground, the taller it will be by the time you're 30. Through the magic of compounding, your small initial investments can snowball over time into a significantly larger sum.

Steps for Young Investors

- Start with a Budget: Knowing where your money goes is essential. Create a budget that tracks both income and expenses.

- Invest Consistently: Make investing a habit, even if it’s a small amount each month. Automation helps!

- Educate Yourself: Knowledge is power in the investment world. Books, podcasts, and finance blogs can be great resources.

Spending Less Doesn’t Mean Living Less

Contrary to popular belief, being frugal isn’t about cutting out fun. It’s about prioritizing spending on things that truly matter to you. Consider a friend who values experiences over things; instead of buying the latest gadget, they invest in memorable travel experiences. Happiness doesn’t always correlate with spending, but with wisely using the resources you have.

Personal Anecdote: The 'Coffee Shop Challenge'

Take, for example, my friend Sarah who decided to skip her daily coffee shop habit. Instead, she started making coffee at home, saving $150 monthly. She invested these savings and watched them grow exponentially over a few years. It was a small change with a big impact!

When to Seek Professional Advice

Even if you feel well-equipped to manage your finances, there are times when consulting a financial advisor makes sense, especially when navigating complex decisions like buying a home, planning for children, or significant tax considerations.

Conclusion: What's Your Financial Game Plan?

Achieving financial independence by 30 is an attainable goal with patience, education, and persistence. What strategies are you implementing to build your wealth? Let’s start a conversation; I’d love to hear your thoughts and experiences in the comments below!