Busting the Myths: Simplifying Your Financial Planning Journey

Transform your financial planning with these practical, friendly insights.

Financial Planning Made Simple

Does the thought of financial planning make you break out in a cold sweat? You’re definitely not alone! It can feel overwhelming, but it doesn’t have to be. Today, I’m here to help demystify the process and give you some insights from a friendly perspective.

Where Do I Even Start?

Let's kick things off with a common query: “Where do I start?” Well, creating a budget is an excellent starting point. Budgets are like the GPS of your financial journey — they help you know where you are and where you're going. No need for fancy apps or spreadsheets. A simple notepad is your best friend here! Highlight your income and list out regular expenses. Your goal is to see where everything is going.

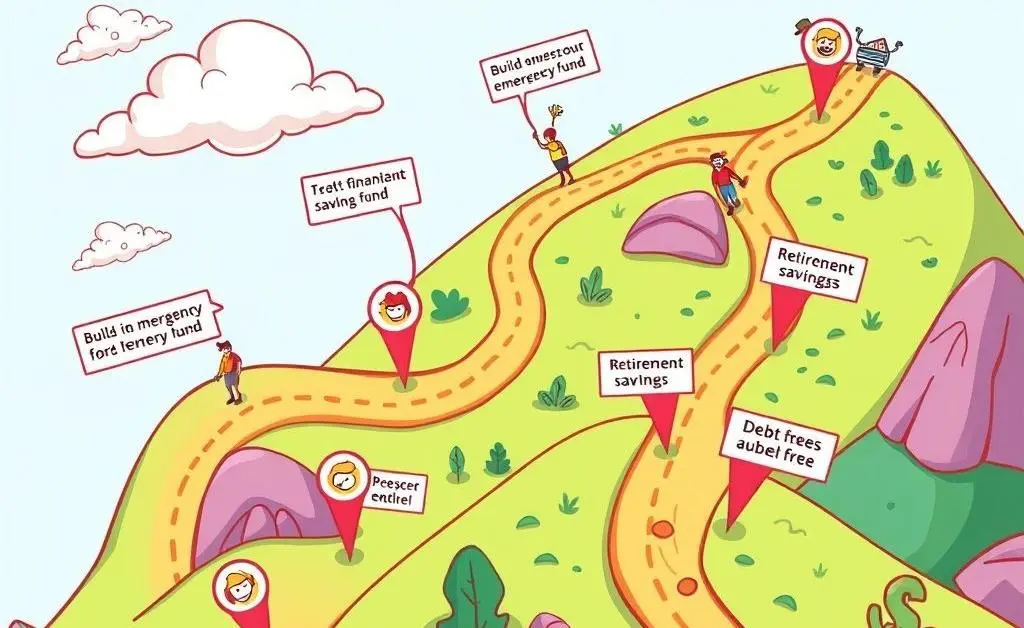

Building the Foundation: Emergency Funds

Are you prepared for life’s unexpected twists and turns? An emergency fund is your safety net. Aim for three to six months’ worth of living expenses. This might sound daunting, but think baby steps — every little bit saved is a win!

Invest Like a Pro—Without the Stress

Investing can feel like stepping into a foreign land without a map. The key? Simplify. Start with understanding your risk tolerance. Are you more of a cautious friend or an adventurous explorer? Diversifying your investment portfolio helps manage risk, spreading your investments across a mix of asset types.

Dreaming of Golden Years: Retirement Planning

Retirement often feels too far away to worry about now, but the earlier you start, the better. Even small contributions to a retirement account can grow over time into a comfortable nest egg. Trust me, your future self will thank you!

FAQs: Answering Your Financial Planning Curiosities

- What's a 401(k)? Think of it as a magic box where you stash pre-tax money, and it grows until retirement.

- Should I pay off debt before saving? Balance is key. Prioritize high-interest debts while saving a small amount each month.

Conclusion: Your Financial Journey Continues

Financial planning doesn’t have to be a chore. With the right approach, it can be empowering. Remember, the journey is uniquely yours and every step you take brings you closer to financial freedom. What step will you take today?