Choosing a Credit Union: Why It Might Be Your Best Financial Move

Discover the perks of credit unions and how they might be the smarter choice for your financial needs.

Have you ever wondered if your bank is really doing the best it can for you? If so, you're not alone. As more people explore their financial options, credit unions are becoming an attractive alternative.

Why Consider a Credit Union?

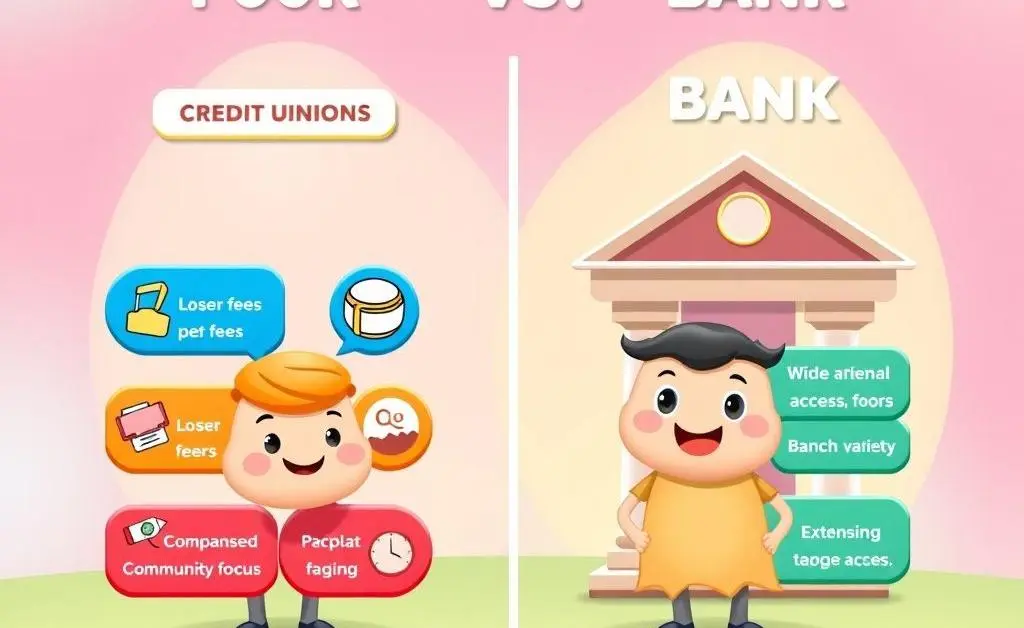

Credit unions offer a wide range of benefits that often outshine traditional banks. Not only are they usually more customer-friendly, but they also tend to have better interest rates and fewer fees. Here's a quick rundown of what sets credit unions apart:

- Member-Owned: When you join a credit union, you're not just a customer, you're a member-owner.

- Better Rates: Enjoy lower loan rates and higher savings yields.

- Local Focus: Credit unions prioritize community impact and involvement.

- Fewer Fees: Many credit unions charge lower fees, making them a cost-effective choice.

A Personal Experience

Let me share a quick story: My friend Jane was unhappy with her bank. She was charged with several unexpected fees and found customer service lacking. She decided to switch to a local credit union instead. Not only did she enjoy better service, but she also felt more connected to her community due to the credit union's local initiatives. Jane wishes she had made the switch sooner!

Choosing the Right Credit Union for You

Not all credit unions are created equal! When choosing, consider factors like location, customer service, and the range of services offered. Do your research to find the one that aligns with your needs.

Engaging with Your Community

Credit unions often engage in community events and sponsorships, giving you a chance to connect and contribute locally. Joining a credit union is more than a financial decision; it's a community investment.

So, could a credit union be the right move for you? By considering your individual needs and doing your research, you might just find that joining a credit union is a decision you won't regret. What are your primary considerations when choosing where to manage your finances?