Choosing the Best HMO for Seniors: A Friendly Guide

Explore the best HMO options for seniors with insights on coverage and costs.

Have you ever found yourself caught in the web of acronyms when trying to find the right HMO plan for a senior family member? You're not alone! Navigating healthcare options, especially for seniors, can be as confusing as teaching your grandma to use emojis. But fear not—I'm here to help clear up the mystery and guide you through selecting the best HMO for seniors with a warm, conversational approach.

Why Seniors Need Special Attention with HMO Plans

As we or our loved ones get older, healthcare needs change. From regular check-ups to potential hospitalization, seniors require plans that are both comprehensive and affordable. Choosing the right HMO can help provide peace of mind, knowing that unexpected medical issues won't derail retirement plans.

What Do Seniors Typically Need in an HMO?

- Comprehensive coverage: Includes hospital visits, lab tests, and preventive care.

- Network of doctors: Access to a wide range of specialists.

- Prescription drug coverage: Ensures all necessary medications are affordable.

- Customer support: Easy access to assistance and advice.

Frances and her husband, Charlie, illustrate this perfectly. After retiring, Charlie faced unforeseen health issues. Their previous plan didn't cover everything, so they were shelling out more than they expected. Enter the right HMO, which changed the game by covering Charlie's specialized medical tests and saving them tons of money!

Key Considerations When Selecting an HMO

Here’s what you should keep an eye on:

1. Coverage Network

Make sure the HMO includes hospitals and specialists that meet your specific needs. A large network means more options.

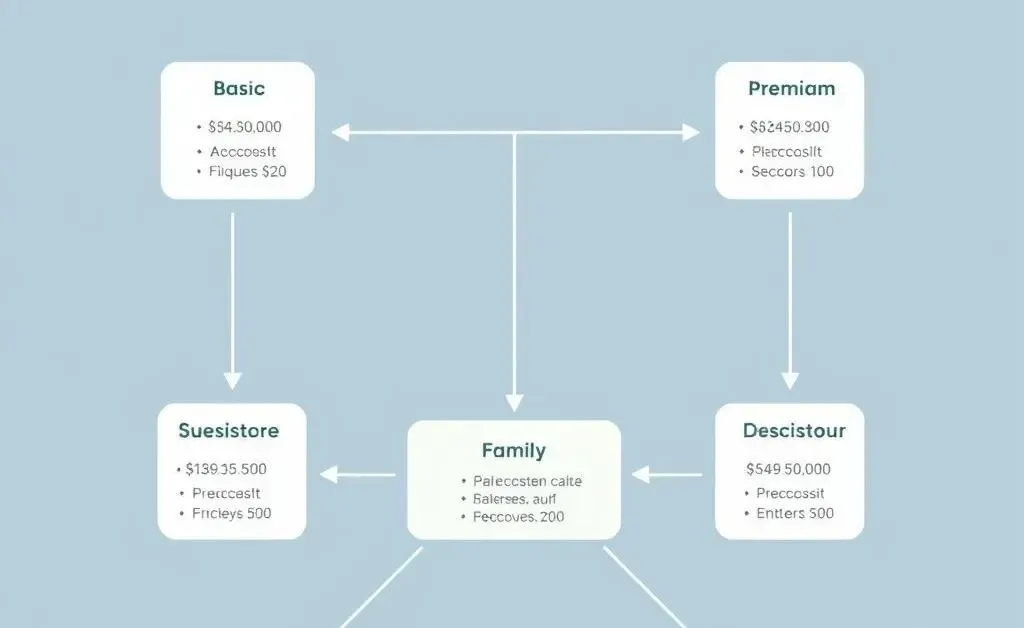

2. Cost Versus Benefits

Consider premiums, co-pays, and deductibles. Balancing cost with the level of service is essential. Imagine you’re assessing cell phone plans—focus on what you’ll realistically use.

3. Ease of Use

Your HMO shouldn’t be complex as quantum physics. User-friendly customer service and easy access to medical care should be non-negotiable.

Taking the Leap: Enroll with Confidence

After weighing these considerations, enrolling should feel like a well-structured decision. Perhaps Frances’s story resonates with you. After thorough research—and a few cups of coffee—they found an excellent HMO that fitted their budget and covered all potential needs, leaving Frances and Charlie to enjoy their golden years without stress.