Choosing the Best Online Brokerage for Residents in Spain

Discover user-friendly tips for picking the top brokerage in Spain despite complex options.

So, you're living in Spain and considering diving into the world of online investing? Great decision! The right brokerage can open up a universe of investment opportunities, simplify the process, and align perfectly with your financial goals. But, as with anything financial, choosing the best option can feel a bit daunting. Let me walk you through it with some guidance to make this a little less overwhelming.

Why Choosing the Right Brokerage Matters

When it comes to investing, selecting an ideal brokerage isn't just about numbers; it's about the experience too. Fees, user interface, available markets — all these factors shape how comfortable you'll feel navigating the investment landscape. Unlike broader banking institutions, brokerages offer specialized tools and resources that can significantly influence your return on investment. It’s the difference between driving an SUV in the city and cruising with a bike through scenic countryside tailored to your needs.

Understanding Your Investment Goals

Let’s start with your goals. Are you saving for a short-term purchase, or is this the beginning of a long-term retirement plan? Being clear on your timeline and purpose will help you filter through the vast options of brokerages available. Maybe you want low-cost platforms or perhaps you're looking for options with rich features and educational tools. Define what matters most to you as this will help refine your choices.

Top Features to Look For

- Fees: It’s notorious how quickly fees can rack up when investing. Look for a platform with low trading fees and no hidden charges. Transparent pricing is a non-negotiable.

- User Interface: An easy-to-navigate platform means you spend less time figuring out the interface and more time making smart investments. Think of it as a dashboard, not a cockpit.

- Customer Support: Stellar customer support can be a lifesaver, especially if you’re new to investing or have transactions that need assistance.

- Market Access: Ensure the brokerage offers access to markets and the types of investments you are interested in, whether it be international stocks, ETFs, or mutual funds.

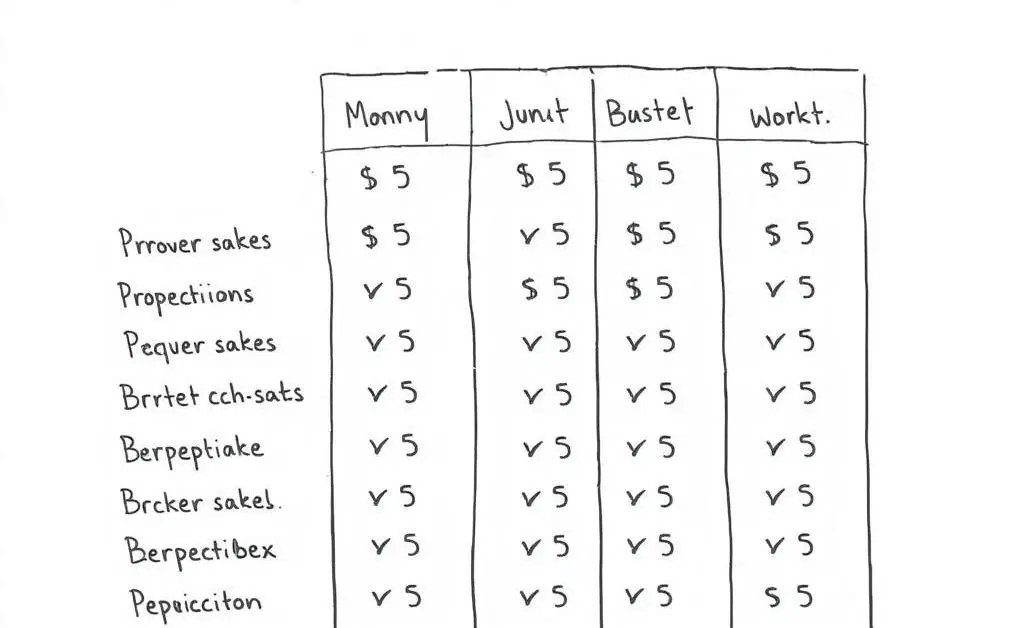

Comparison: A Quick Look at Popular Brokerages for Spanish Residents

To make this actionable, let's glance at some popular brokerages that Spanish residents often consider:

- Broker B123: Known for its low fees and excellent customer service. A fantastic first stop if you're just starting.

- TradeUpSpain: Offers a sleek interface and access to international markets, ideal for adventurous investors.

- InvestNow: Appreciated for in-depth educational resources, making it perfect for those who love to learn.

Setting Up and Taking the Plunge

After narrowing down your choice, setting up an account is usually straightforward online. It typically involves filling out some personal information and proving your identity. Once you’re all set, start small. Test the waters with a few modest investments to get a feel for how everything works. Slowly, as you gain confidence and knowledge, you can expand your portfolio.

Final Thoughts

Choosing a brokerage is a significant first step in your investment journey, shaping not only your financial future but also how you'll feel about investing every day. Take it slow, trust your instincts, and remember – the best choice aligns with your lifestyle, goals, and comfort level. Here’s to making wise financial decisions and enjoying each step of the investment journey in beautiful Spain.