Choosing the Right Core Investment: A Simple Guide

Discover how to select a core investment strategy that matches your financial goals.

Imagine you’re sitting at your favorite coffee spot, sipping on a warm latte, while the concept of core investments swirls in your mind. It’s a topic that sounds both essential and a bit intimidating, especially when whispered in financial circles. But let’s walk through it, together.

What is a Core Investment?

A core investment can be seen as the backbone of your financial portfolio. It’s designed to provide stability and consistent growth, akin to a trusted friend you can rely on. Think of it as a steady rock amidst the swirling tides of more volatile investments.

Why Choose a Core Investment Strategy?

There are many reasons to opt for a core investment strategy. For one, peace of mind is invaluable. You want something dependable that doesn’t keep you up at night. This kind of strategy can provide a balanced anchor, allowing you to take calculated risks elsewhere.

How to Select Your Core Investment Option

Here’s where the fun begins. Selecting a core investment involves a little matchmaking between you and your financial goals.

- Identify Your Goals: What do you want from your investments? Retirement security, buying a house, or perhaps funding a child’s education?

- Understand Risk Tolerance: Are you okay with potential ups and downs, or do you prefer steadiness?

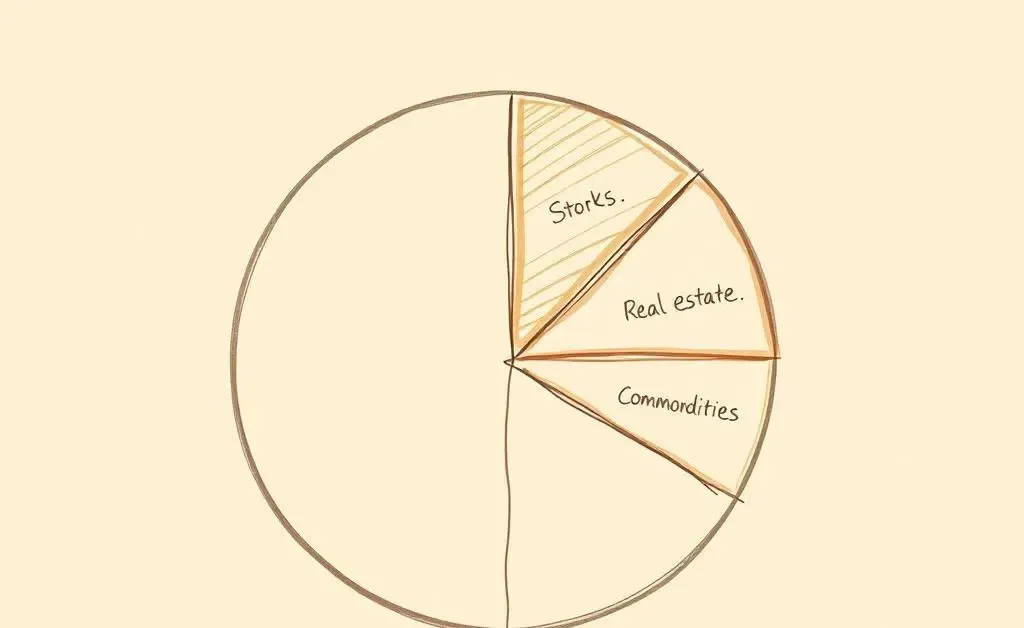

- Diversify Wisely: Don’t put all your eggs in one basket. Spread the risk by selecting a mix of stocks, bonds, and perhaps some real estate.

Real-Life Considerations

Picture this: a friend of mine, Emma, wanted her investments to support her dream of opening an eco-friendly bookstore. By choosing a core investment strategy with low-risk assets, she maintains a stable financial ground while channeling additional savings into her dream.

When to Review Your Core Investments

Like a good book, your investment strategy should be revisited and revised over time. Keep an eye on major life changes or shifts in your financial plans. These are prompts to reassess your core investments to ensure they still align with your path.

Wrap a warm sweater around your investment strategy and revisit it over a cozy cup of tea every so often. You might find that as your life evolves, so too should your financial decisions.

And while financial landscapes may change, the essence of a thoughtful approach to core investments remains timeless: it’s all about aligning with your dreams, values, and comfort zone. Happy investing!