Choosing the Right Credit Union: What to Consider and Why It Matters

Explore key factors in choosing a credit union for your financial needs.

Have you ever wondered if joining a credit union might be the right move for your finances? Maybe you've heard about them from friends or family but weren't quite sure about what makes them stand out. Well, let's dive into why credit unions could be a fantastic option for your financial needs.

What Makes Credit Unions Unique?

First things first: what sets a credit union apart from a traditional bank? Unlike banks, credit unions are member-owned, which often means they focus more on providing value to their members rather than profit. This could translate into better interest rates, lower fees, and more personalized customer service.

Key Benefits of Credit Unions

- Lower Loan Rates: Need a loan? You're likely to find lower rates at a credit union, making them a great choice for borrowing.

- Higher Savings Rates: Credit unions often offer better rates on savings accounts, helping you grow your money faster.

- Member Support: Being member-owned means credit unions focus on member satisfaction, which typically results in excellent customer service.

Things to Consider When Choosing a Credit Union

Now that we've looked at the benefits, how do you choose the right credit union for you? Here are a few factors to keep in mind:

- Membership Requirements: Some credit unions have specific eligibility criteria, so it’s important to check if you qualify.

- Branch and ATM Access: Consider the convenience of branch locations and ATM networks, especially if you often need in-person services.

- Technological Tools: If mobile banking is essential for you, look for credit unions with robust digital platforms.

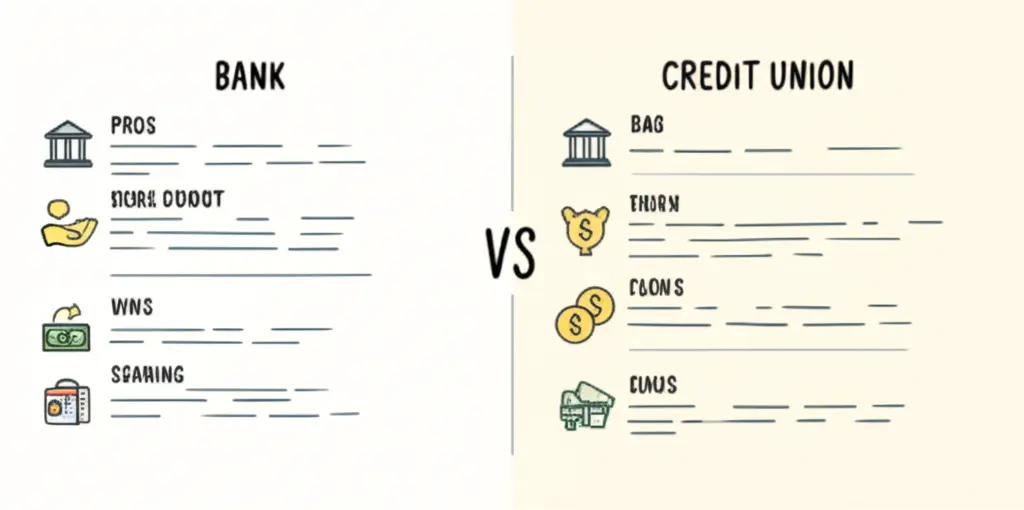

Comparing Credit Unions and Banks

It might be helpful to line up a few credit unions and banks side by side to see what each offers. Keep an eye out for differences in service, fees, and the personal touch.

Final Thoughts

Overall, the choice between a bank and a credit union boils down to what you value most in your banking experience. Are competitive rates and member support priorities for you? If so, a credit union may be the perfect fit.

If you've had experiences with credit unions or are considering joining one, I'd love to hear your thoughts! What factors are most important to you when choosing where to bank?