Choosing the Right Term Life Insurance in Canada: A Personal Guidance

Explore insightful tips on selecting term life insurance in Canada.

Hey friend, let's talk about something essential yet often overlooked—term life insurance in Canada. Whether you're embarking on a new life chapter or just looking to secure peace of mind, it's worth understanding how to choose the right policy for your needs.

Understanding Term Life Insurance

Term life insurance is like a trusty safety net. It provides coverage for a specific term, giving you the assurance that your loved ones are financially protected if the unthinkable happens. But how do you choose the right policy amidst all the options available?

Why Term Life Insurance?

Why not start with why? Term life insurance is often more affordable than its permanent counterparts, making it appealing for many, especially if you're juggling other financial commitments. It's particularly useful if you only wish to cover expenses that would diminish over time, like a mortgage or your children's education.

Key Considerations When Choosing a Policy

Choosing the right term life insurance isn't just about the lowest premiums. There are several factors to consider:

- Coverage Amount: Assess how much your loved ones might need. Consider debts, living expenses, and future financial obligations.

- Length of Term: Do you need coverage for 10, 20, or 30 years? Align the term with significant life events or timelines, such as children finishing school.

- Provider's Reputation: It’s important to select an insurer with a strong reputation and financial stability. A reliable company is your assurance that claims will be handled smoothly down the road.

Comparing Providers

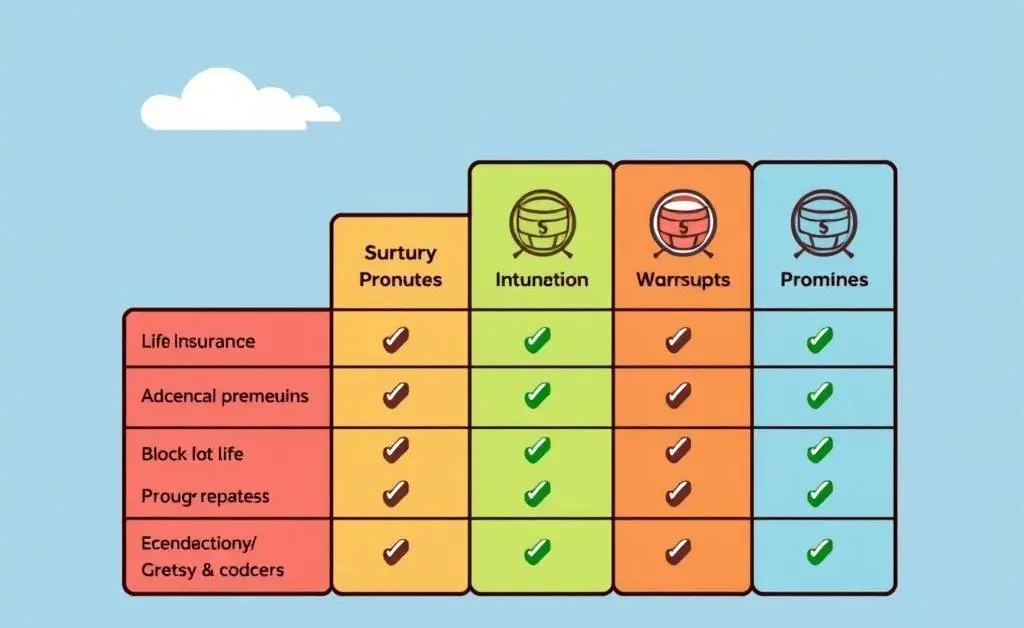

A practical approach might be to list out potential insurers and make a side-by-side comparison. Look at key details like policy features, customer service reviews, and claim handling efficiency. This can provide clarity and assist in making a confident decision.

Final Thoughts

Navigating term life insurance is more about effectively planning for life's uncertainties. It's less about the immediate and more about future peace of mind.

As you make your choice, keep in mind that the real value of term life insurance lies in its ability to offer stability in your loved ones' lives during tough times. Reflecting upon this can guide you to the right decision, tailored to your family’s situation.

So, what are your thoughts? Are you ready to explore your options further? Please feel free to share if there's anything specific you'd like more insights on—I'm always here to help!