Crafting Your Path to Financial Planning Success

Discover how to successfully kickstart your financial planning career with these practical insights and tips.

Have you ever wondered what it truly takes to succeed in the world of financial planning? If you're ready to dive into this career path, you’re not alone! The journey to becoming a Certified Financial Planner (CFP) is an exciting one, full of learning and personal growth. Let's explore how you can navigate this path with confidence and clarity.

Why Choose a Career in Financial Planning?

Choosing to pursue a career as a CFP is more than just a financial decision. It’s about finding a role where you can genuinely help others while securing your own financial future. People value financial planners for the insightful guidance they offer, making it a rewarding profession both emotionally and financially.

The Road to Certification

Embarking on the road to certification involves several steps, similar to an epic quest. Here's what it looks like:

- Education: Complete the required coursework from a CFP Board-registered program. This foundational knowledge gives you a solid grasp of financial principles.

- Exam Preparation: Study thoroughly for the CFP exam. Utilize resources like practice exams and study groups to enhance your understanding.

- Experience: Accumulate the necessary professional experience. This might involve working under a seasoned financial advisor.

- Ethics: Adhere to the CFP Board's Standards of Ethics to ensure you act in your clients' best interests.

Preparing for the CFP exam can feel daunting, so let's add a splash of real-life humor to lighten up! Imagine your cat deciding to nap on your keyboard just as you're on a roll with your study sessions. It’s all part of the journey, and every small victory counts!

Building Client Relationships

Once you're certified, building and maintaining client relationships becomes your new north star. Imagine sitting down with your first client, eagerly outlining financial goals that align with their dreams. The joy of witnessing their growth and achievement is incomparable.

Tips for Engaging Client Interactions

Here are some tips to make your client interactions meaningful:

- Listen Actively: Understand your client's unique needs and tailor your advice accordingly.

- Communicate Clearly: Jargon-free explanations foster trust and clarity.

- Be Transparent: Maintain openness about fees and potential risks to build reliability.

Looking Ahead

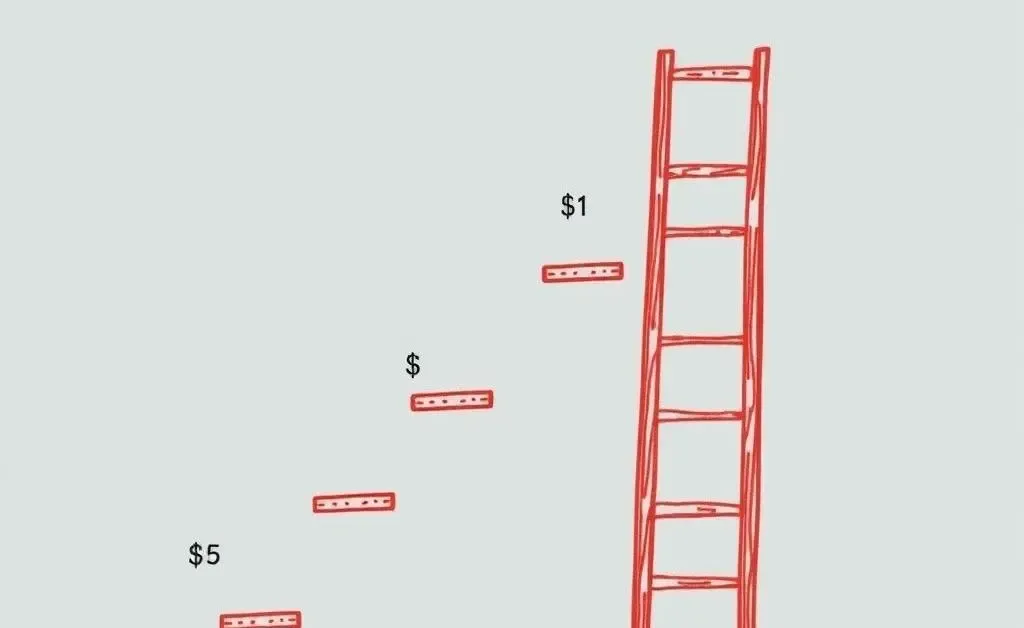

Your journey as a CFP doesn't pause at certification. Continued education and adapting to industry changes keep you sharp and ready to offer the best advice. Picture the most visually satisfying career ladder, where each step up represents new knowledge gained and milestones achieved.

In the ever-evolving world of finances, what's one aspect you’re curious to explore further as you step into this fulfilling career? Let's continue this conversation.