Creating a Balanced Investment Portfolio: A Guide for Curious Investors

Discover how to balance and optimize your investment portfolio with practical insights.

Why Balancing Your Investment Portfolio Matters

Ever felt like your investments just aren’t working as hard as you are? Balancing your investment portfolio can change that feeling. The primary goal of balancing is to manage risk and maximize your quick and long-term gains.

Understanding Your Financial Goals

Think back to when you were a kid, dreaming of your future. What did it look like? Whether it was a big house, traveling the world, or simply ensuring comfort and security, these dreams help guide your financial goals today.

Start by defining your financial goals. Are you saving for a house, planning retirement, or building an emergency fund? Once you’re clear, tailor your portfolio accordingly.

Diversification: The Key to Balance

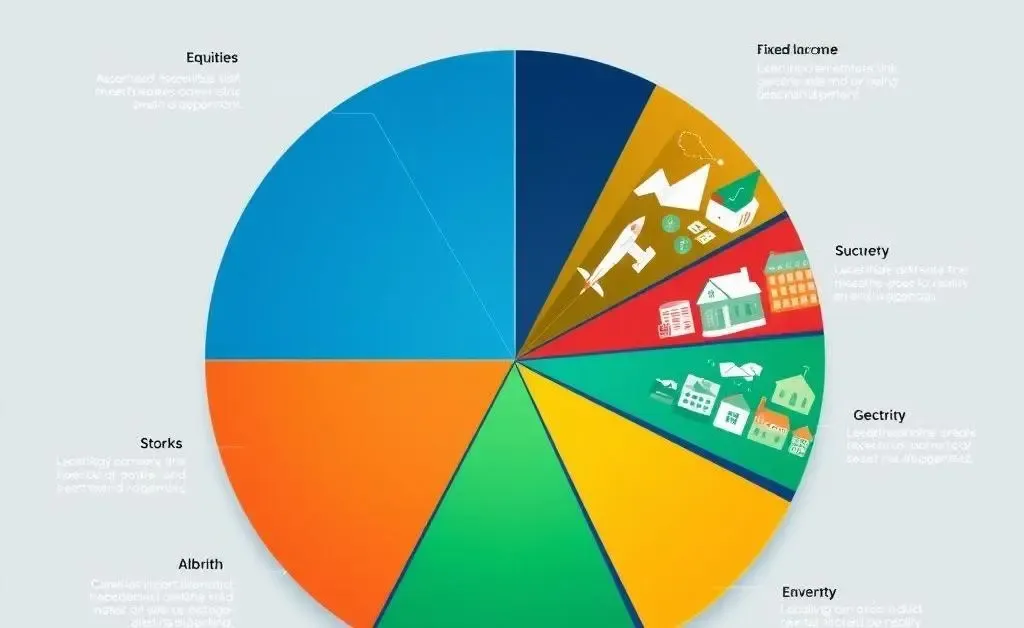

After setting your goals, the next step is diversification. It might sound complex, but think of it like a balanced diet—mixing different food types keeps you healthy. Similarly, spreading investments across various asset types reduces risk.

- Stocks: Potential for high returns but more volatile.

- Bonds: Lower risk with steady returns.

- Mutual Funds and ETFs: These combine multiple stocks/bonds, offering built-in diversification.

- Real Estate: Physical assets that can provide rental income and long-term appreciation.

Cultivating Patience for Long-Term Gains

Here’s a little secret: patient investors often see the best results. Imagine planting a tree. Initially, it appears as if nothing’s happening, but over time, it strengthens and grows, just like your investments.

Long-term strategies often outperform quick, reactive decisions. Embrace market fluctuations and avoid panicked selling.

Conclusion: Crafting Your Portfolio Strategy

Creating a balanced investment portfolio is part art, part science, and all about understanding yourself and your goals. As you navigate the investing world, keep asking: What feels right for me now and will support my dreams tomorrow?

What are your financial goals, and how are you planning to reach them?