Creating a Balanced Investment Portfolio: Tips for Every Investor

Learn how to balance your investment portfolio with these practical tips.

Hey there! Let's talk about something that might seem complex but is really just organized chaos — your investment portfolio. If you’ve ever peered into the world of investing, you’ve likely come across terms like ‘asset allocation’ and ‘diversification’. These aren't just buzzwords; they’re key to making sure your investments can weather any storm.

Why Balance Matters in Your Investment Portfolio

Imagine trying to cross a river on a tightrope while juggling flaming torches — sounds impossible, right? But what if you had a pole to balance? Much easier! That’s like your portfolio. Balancing it means spreading risk across various investments, so when one torches (ahem, sectors) falter, others keep you stable.

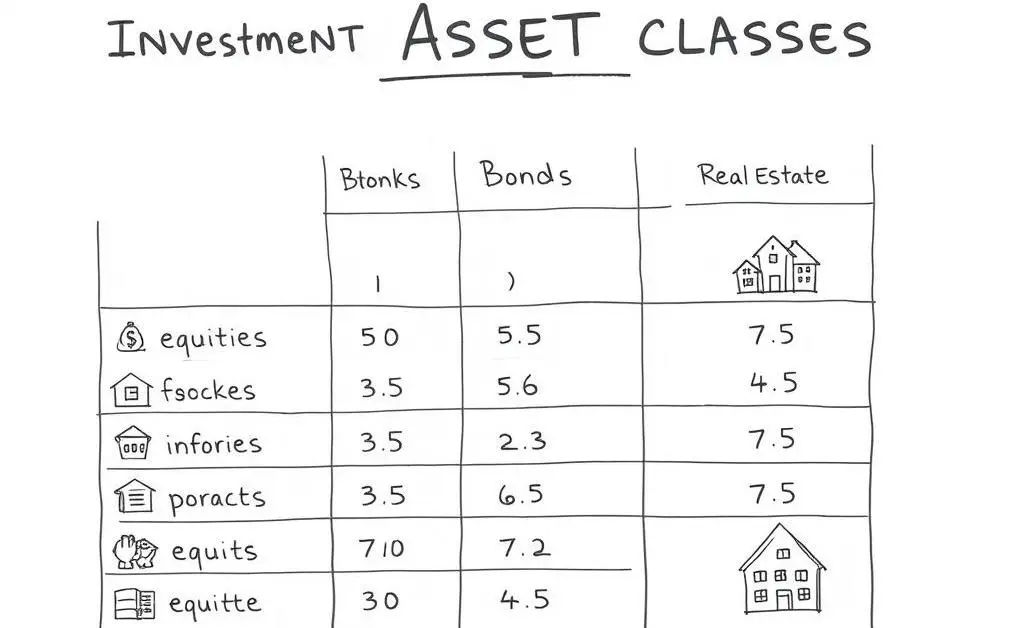

Types of Assets to Consider

When people say “balance your portfolio,” they mean mixing things up among different asset classes. Here's a quick list to get you going:

- Stocks: The bread and butter — can be volatile but offer high returns.

- Bonds: Consider these the calm waters; they provide steady income.

- Real Estate: A tangible asset that can yield rental income.

- Commodities: Gold, oil, and other resources diversifying further.

Reviewing Your Portfolio: A Crucial Step

Not to sound like a human calendar, but regular reviews of your portfolio can bolster your strategy against market shifts. Life changes, and so can your financial goals! Think of this review like a check-up at your favorite diner — you know you’ll walk out feeling better.

When to Rebalance?

Changing your investments isn’t a weekly affair. Consider these moments:

- Once a year — a good rule of thumb for most.

- Major life changes — new job, wedding, adding a member to your family.

- Market shifts — when your allocations drift more than 5% from your plan.

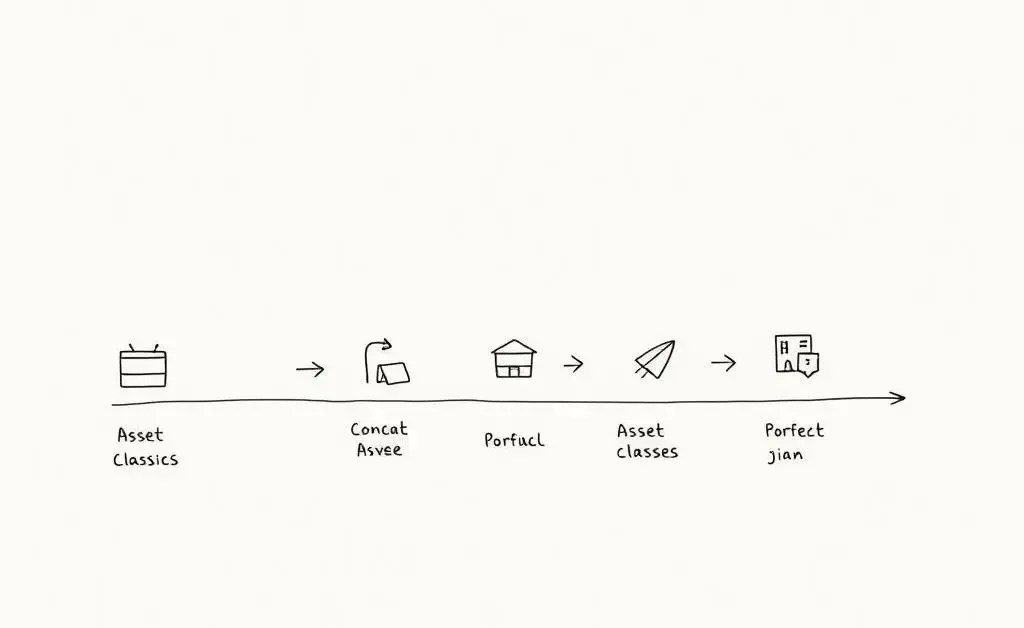

Your Investment Journey: Steps to Success

Investing can sometimes feel like a long, winding road — but a little mapping can carry you a long way. Here’s a straightforward approach to build and manage your portfolio:

- Identify your goals: Why are you investing?

- Assess your risk tolerance: How much ground (or profit) are you okay losing in the short term?

- Create a diversified plan: Mix different types of assets.

- Regular monitoring: Keep an eye, but don’t micromanage.

So, what’s your next move? Get your portfolio planned and balanced! And if you have any other tips or need advice, feel free to share in the comments below!