Credit Card Churning: How to Maximize Rewards Like a Pro

Unlock the secrets to maximizing credit card rewards without damaging your credit score.

Have you ever felt like your stack of credit cards is staring at you judgmentally from your wallet? Well, you're not alone! Many people find the world of credit cards mystifying, especially when it comes to maximizing rewards. But today, we're going to peel back the layers of credit card churning, a strategy savvy consumers use to earn significant rewards without hurting their credit score.

What is Credit Card Churning?

In the simplest terms, credit card churning involves strategically applying for credit cards to earn sign-up bonuses and lucrative points, then canceling the cards once the bonuses have been redeemed. This might sound funny to some, but it's more prevalent than you'd think!

Here's a quick checklist to get you started on your churning journey:

- Research cards offering top-tier sign-up bonuses.

- Ensure you meet the spending requirements without overextending your budget.

- Keep a detailed record of all card terms, benefits, and annual fees.

- Consider the impact on your credit score before applying for new cards.

- Plan your churn strategy, including when and how to close cards.

Does Credit Card Churning Affect Your Credit Score?

One of the biggest questions people have is whether churning negatively impacts their credit score. While opening and closing accounts can have short-term effects on your credit, the long-term impact is generally minimal if managed responsibly. It's crucial to maintain a high credit utilization ratio and regular payment history. Remember, churning isn't for the financially reckless!

Managing Your Churning Strategy

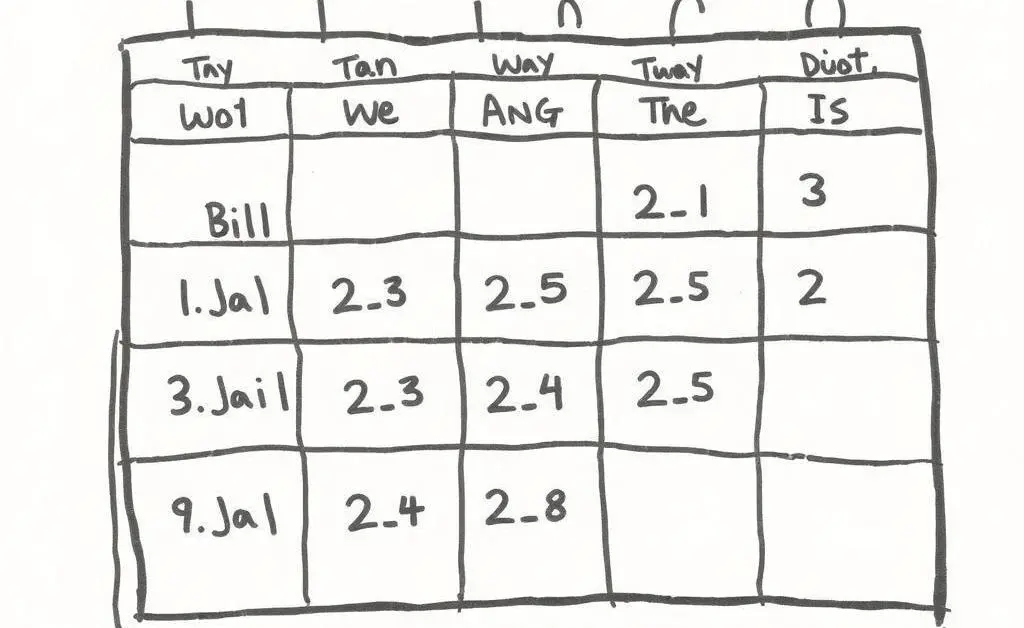

My friend Sarah - let's call her the 'Queen of Churning' - once shared her golden rule: "Treat your churn strategy like a strategic game." She meticulously tracks everything on a dedicated calendar and rarely misses out on earning those juicy bonuses!

The tools of her trade? A budgeting app, a calendar app specific for scheduling payment dates, and a passion for travel that feels endless. Sarah often scores free flights and hotel stays with her bonus points, making small adjustments feel like a jet-set lifestyle upgrade.

Are You Ready to Start Churning?

In conclusion, credit card churning isn't about reckless card applications; it's about strategically leveraging offers in your favor. Curious to see if this method can level up your rewards game? I'd love to hear about your credit card churning experiences or any strategies you're considering in the comments below!