Credit Unions vs. Banks: Is the Grass Greener on the Cooperative Side?

Explore the benefits of choosing credit unions over banks in this conversation about community-focused finance.

Have you ever wondered if switching from a traditional bank to a credit union might be worth it? You've probably heard murmurings about credit unions being the underdog in the financial world — community-oriented, member-owned, and supposedly the 'good guys'. Let's dive into whether joining one could actually make your financial life better.

The Core Differences: What's in a Name?

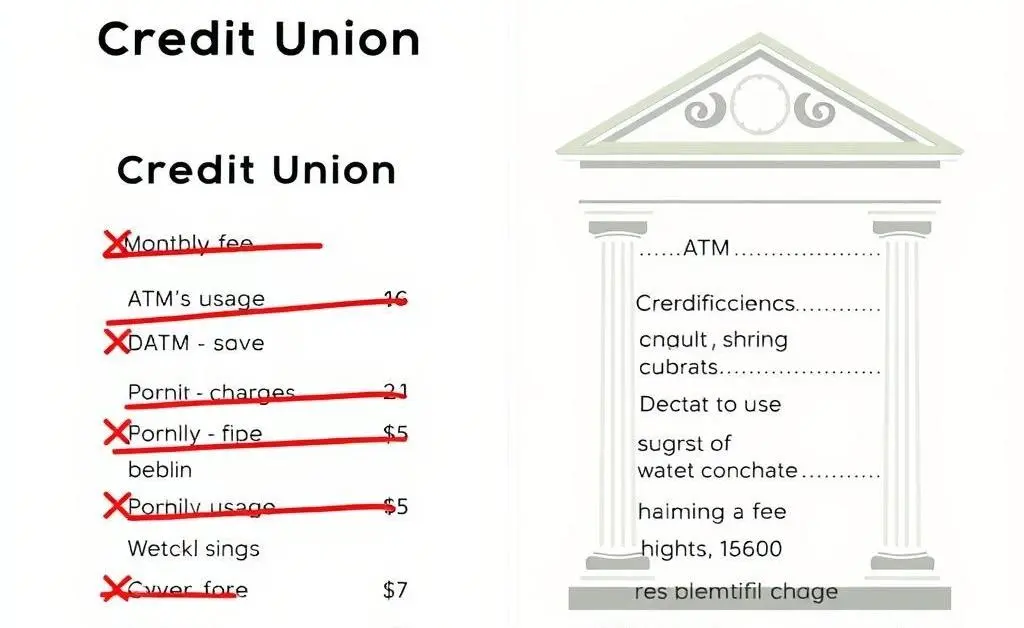

Before we get into the nitty-gritty, let's talk about what sets a credit union apart from your average bank. While big commercial banks are designed to make a profit for their shareholders, credit unions operate as not-for-profit cooperatives. This means credit unions return profits to their members, usually in the form of lower fees and better savings rates.

Here are some standout features you might enjoy:

- Typically lower fees and competitive interest rates

- Emphasis on customer service and community building

- Voting rights on important decisions affecting the institution

A Tale of Two Fees: A Relatable Anecdote

Let's imagine two friends, Alex and Jamie. Alex banks with a huge national bank, while Jamie is with a local credit union. One day, they compare bank statements over coffee. Alex notices a slew of charges — ATM fees, maintenance fees, even a hefty fee for overdrawing by a few cents. Meanwhile, Jamie’s credit union account shows hardly any fees, and the savings account offers a surprisingly higher interest rate.

Community-Focused Approach: More Than Just Numbers

Beyond financial benefits, credit unions often emphasize giving back to the community. Members are seen as part of a cooperative community with aligned interests, rather than just customers. Many credit unions participate in local events, fund scholarships, and support neighborhood initiatives.

On the lighter side, joining a credit union might also mean free donuts on International Credit Union Day! Who could say no to that?

Is a Credit Union Right for You?

While the personal touch and potential cost savings of credit unions are appealing, they might not be perfect for everyone. Some people might miss the broader ATM network or the full-featured smartphone apps provided by big banks.

If you’re considering a switch, it’s worth doing some research and maybe even visiting a few credit unions in your area. After all, managing your finances is a personal journey, and finding the right partner can make all the difference.

Have you ever switched from a bank to a credit union? What has your experience been like?