Decoding Car Insurance: A Simple Guide to Making Informed Choices

Learn the essentials of car insurance to make informed decisions easily and confidently.

Hey there! If you're feeling overwhelmed by car insurance, you're not alone. When I first got my car, diving into the world of premiums, deductibles, and coverage types felt like navigating a maze. So, let’s break down car insurance in simple terms—it's all about helping you choose a policy that fits like a glove.

What is Car Insurance, and Why Do You Need It?

Car insurance is essentially a safety net. It protects you financially in case of accidents, theft, or damage. The basics include liability coverage, which is mandatory in most places. This covers the costs if you're responsible for an accident, including damage to others' property and medical expenses.

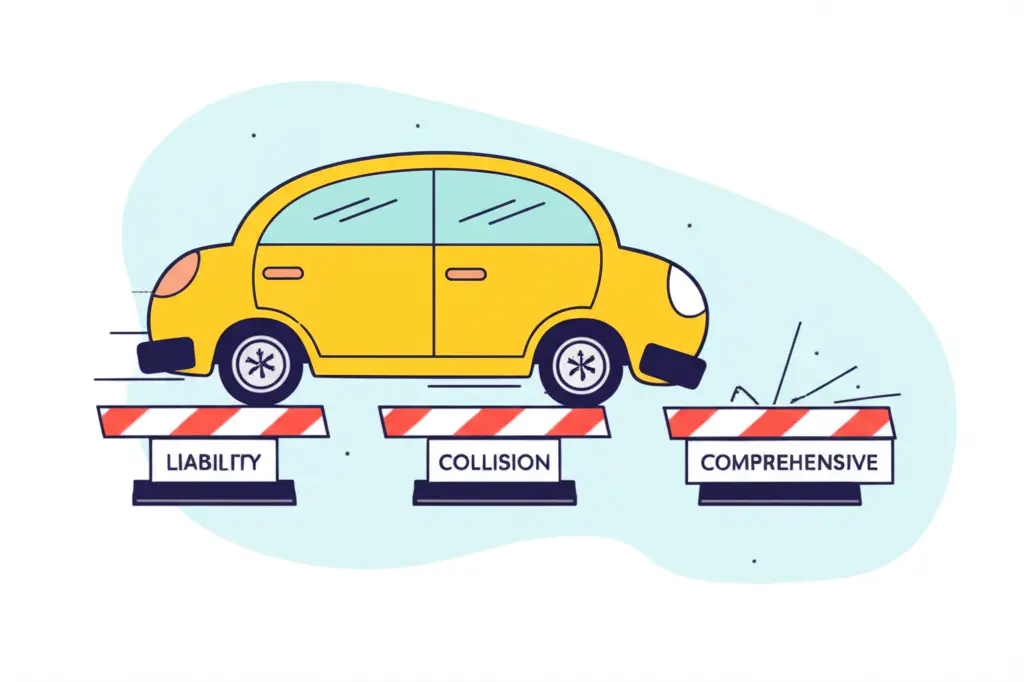

Understanding the Coverage Types

There are several types of coverage you can choose from, each serving a unique purpose:

- Liability Insurance: Covers damages to others when you are at fault.

- Collision Coverage: Pays for damage to your car in case of an accident.

- Comprehensive Coverage: Covers theft or damage not caused by collision, like natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you if you're hit by a driver without adequate insurance.

Factors Influencing Your Insurance Rates

Insurance premiums can vary widely based on several factors:

- Your Driving Record: Clean record equals lower rates.

- Car Make and Model: More expensive cars often cost more to insure.

- Location: Urban areas may have higher rates than rural settings.

- Age and Experience: Younger drivers typically pay more.

Shopping for the Best Policy

When shopping for car insurance, it pays to compare rates from multiple providers. Don't shy away from asking questions—an informed consumer saves money. Consider factors beyond price, like customer service and claim processing.

Lastly, always read the fine print. You want to make sure that your policy covers exactly what you think it does. Sometimes, the cheapest option isn’t always the best one for your needs.

The Bottom Line

Understanding car insurance can feel daunting, but it's a vital step towards financial security and peace of mind. By familiarizing yourself with the terms and options, you can customize your coverage to protect yourself and your vehicle optimally. Do you have a car insurance tip or experience to share? I’d love to hear your thoughts!