Decoding Financial Independence: How Much Do You Really Need?

Explore the essentials of financial independence and how much you truly need to achieve it.

Hey there! So, you're probably here because you've heard people talking about financial independence (FI) and you're curious about what it really takes to get there, right? Let's dive into this journey together, exploring how much money you actually need to wave goodbye to that daily grind and say hello to financial freedom.

What Is Financial Independence?

At its core, financial independence means having enough assets and income to cover your living expenses without needing a traditional job. Imagine waking up on a Monday morning knowing you're financially secure whether you work or not — sounds like a dream, doesn't it?

How Much Does It Really Take?

The golden rule in FI circles is often the '4% rule', which suggests you'll need about 25 times your annual expenses saved up. If you spend, say, $40,000 a year, you’d aim for a nest egg of around $1 million. But hold on! That’s just a starting point. Let's see why.

- Cost of living: This varies greatly depending on where you live. Urban schlep? Expect to spend more than if you're living that sweet small-town life.

- Lifestyle Choices: Want to travel the world or stick to home comforts? Your lifestyle dreams hugely impact your FI number.

- Inflation: Prices change, and your plan should account for that sneaky silent factor known as inflation.

Customizing Your Strategy

It's essential to personalize your FI journey. Maybe you're a minimalist at heart, or perhaps you want a more lavish lifestyle. Here are ways to tailor your path:

Track Your Expenses

Understanding your spending habits is key. Apps like Mint or YNAB can help you get a clear picture of where your money goes. This step allows you to cut unnecessary expenses and save faster.

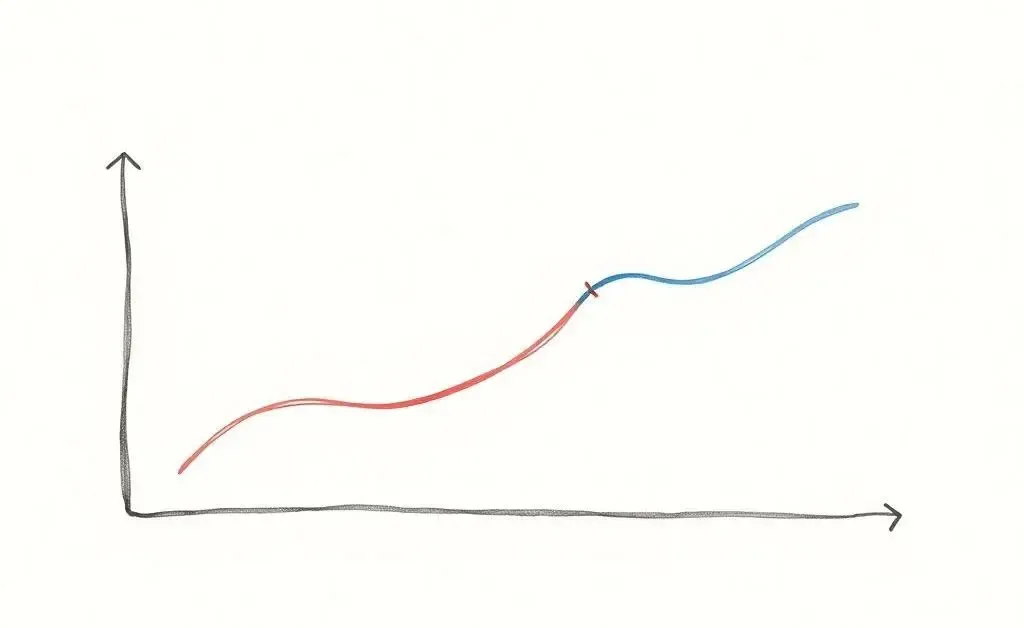

Increase Your Savings Rate

Boosting the amount you save monthly can shave years off your path to FI. Try automating savings or tweaking your budget to funnel more into your financial goals.

Invest Wisely

Investing is a powerful tool for growth. Whether you're into index funds, real estate, or starting a business, choose avenues that align with your risk tolerance and interests.

Final Thoughts

Achieving financial independence is a highly personalized journey that requires introspection, planning, and a bit of patience. Take those first steps today, and figure out what financial independence looks like to you. At the end of this exploration, you'll know exactly what you need to reach your goal. Remember, it's not just about money — it's about freedom, security, and living a life that aligns with your values.

Ready to start your path to financial freedom? What's your first move?