Decoding Insurance: Your Guide to Understanding Policies and Coverage

Navigate the world of insurance easily with this practical guide.

Ever found yourself scratching your head trying to decode the complexities of an insurance policy? Trust me, you're not alone. Many people feel overwhelmed when faced with insurance jargon, wondering which coverage suits them best. Today, let's sift through the tangled world of insurance and emerge with clearer insight and a bit more confidence.

Understanding the Basics of Insurance

First things first, why bother with insurance at all? At its core, insurance is about protection—shielding you from life’s unpredictable events. Whether it's your car, home, health, or even your pet, having the right insurance can spare you from major financial headaches.

Types of Insurance You Might Need

- Health Insurance: This is crucial for covering medical expenses that can skyrocket without warning.

- Auto Insurance: Mandatory in many places, it protects you from the financial fallout of accidents.

- Home Insurance: Covers damages and liabilities related to your home.

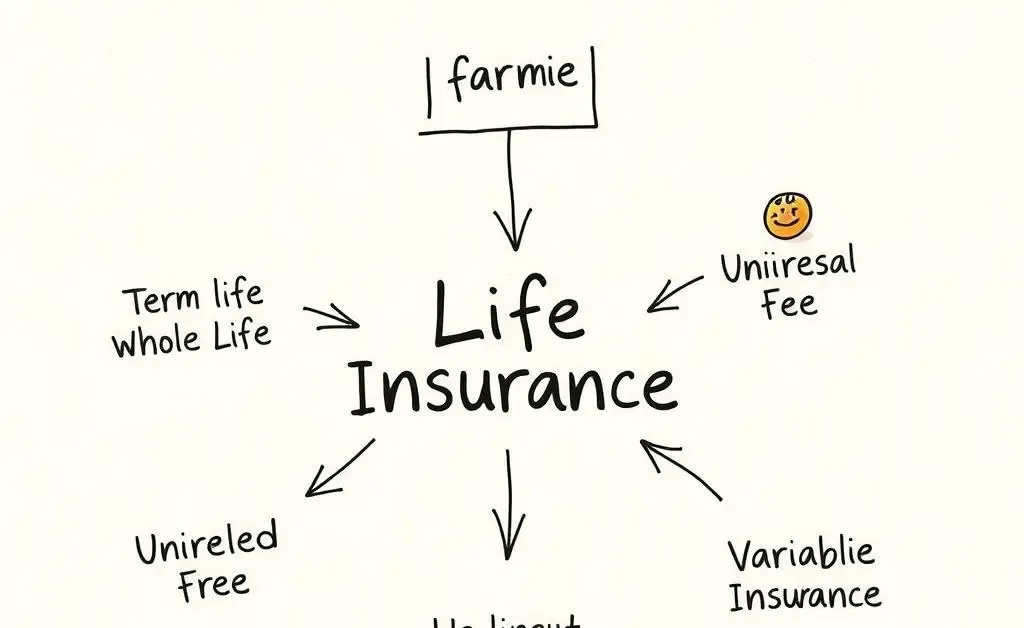

- Life Insurance: Provides financial support to your loved ones in case of your untimely passing.

An old friend of mine had a classic aha! moment—more like a what-on-earth-have-I-been-doing moment—while planting roses in his backyard. He realized he had been wary of insurance simply because he hadn't understood it. After taking the time to read up on his options, he ended up saving significant money on his car insurance by switching providers—proof that a little knowledge goes a long way!

Demystifying Insurance Jargon

Terms like 'deductibles', 'premiums', and 'liabilities' can seem daunting. So, here's a simplified breakdown:

Premiums

These are the payments you make to keep your policy active. It's the cost of transferring risk to the insurer.

Deductibles

The amount you pay out of pocket before your insurer steps in. Higher deductibles generally mean lower premiums.

Liability Coverage

This part of your insurance protects you from legal responsibility in case of an accident.

Staying Informed and Engaged

Insurance doesn't have to be a daunting mountain to climb. Keeping tabs on your coverage needs, revisiting your policy annually, and understanding your options can make insurance work in your favor. Admittedly, it also helps to ponder: do you need to insure that surprise collection of vintage keychains?

As we wrap up, think about this: when was the last time you reviewed your insurance policies, and what was the most surprising thing you learned? Share your thoughts and let's keep this conversation going!