Decoding Mortgage Rate Quotes: What Every Home Buyer Needs to Know

Discover the essentials of understanding mortgage rate quotes in a friendly, informative blog.

When you're navigating the path to buying a home, there's a good chance you've found yourself trying to make sense of the mysterious mortgage rate quotes. I get it—it can seem like deciphering a new language! But don't worry, I'm here to walk you through it in plain, simple terms.

What Is a Mortgage Rate Quote?

Think of a mortgage rate quote as your ticket price for securing a loan from lenders to buy a house. It lists the interest rate, how long you'll repay (the term), and any additional fees. Just like shopping for a new gadget, you'll want to compare these quotes to ensure you're getting the best deal.

Why Are Quotes So Different?

Ever notice how sometimes quotes vary? It's like trying to pick the best pizza place where each has a different specialty. The variation can be due to several factors: credit score, loan amount, location, or even when you apply.

Lenders assess the risk in lending money. The higher the risk, the higher the rate, so ensuring your credit history is in good shape can help you snag a better quote.

The Components of a Quote

- Interest Rate: The percentage you'll pay annually on your loan.

- Annual Percentage Rate (APR): Unlike the plain interest rate, this includes fees and gives a more comprehensive cost estimate.

- Points: These could lower your interest rate; it's fascinating how paying upfront can save money later!

How to Compare Quotes?

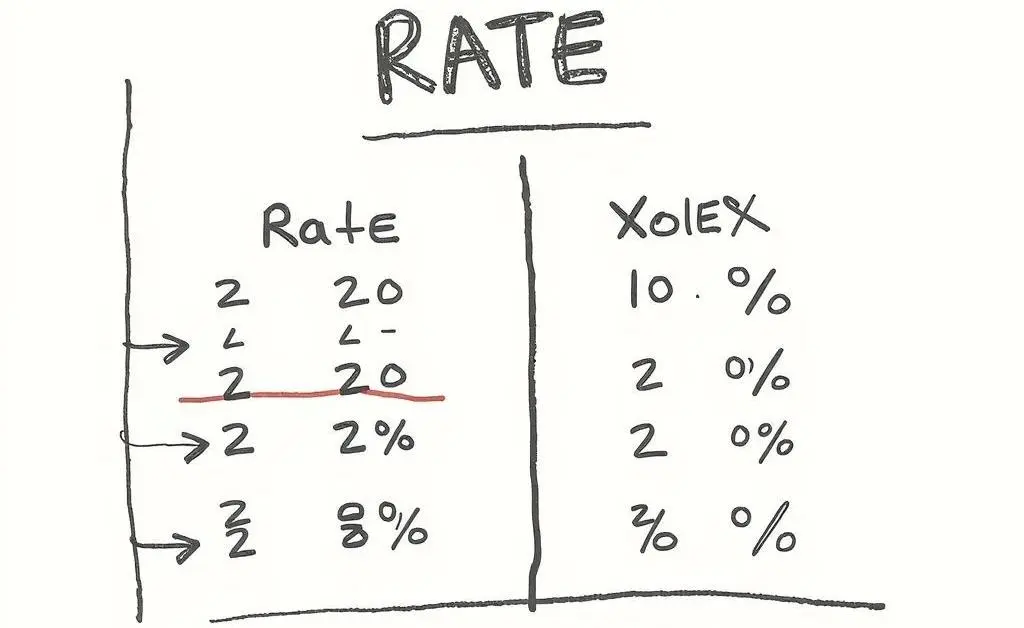

When comparing quotes, it's crucial to compare apples to apples. Focus on the APR rather than the interest rate alone. You might want to create a table (like the one you might scribble on a notepad) listing different APRs, terms, and monthly payments.

Consider this: does one lender offer better terms if you pay a higher upfront cost? Or maybe another offers flexibility you desire? It's like picking that perfect vacation spot—you need to weigh what's essential for your journey.

The Final Decision

Once you've narrowed it down, take a deep breath. Perhaps involve family members or trusted friends in the discussion.

Rates aren't everything—look at customer service, lender reputation, and your comfort with the terms too.

Armed with your newfound knowledge, you'll be chatting away with mortgage lenders like a pro! Got any unique experiences or tips about mortgage rates? I'd love to hear your thoughts in the comments below! Every home buying journey is different, and sharing knowledge helps us all make informed decisions.