Decoding the Right Moment to Exit a Real Estate Investment

Discover when it's best to exit a real estate investment with confidence.

Deciding the perfect moment to exit a real estate investment can feel like an overwhelming decision. I've been there, nervously contemplating whether holding on is worth it or if it's time to pack up and move on. But how do you truly know when it’s the right time to say goodbye?

Signs It May Be Time to Exit

Every investor faces this dilemma, and recognizing the signs can help you pave your path clearly and confidently. Here are a few critical indicators to keep an eye on:

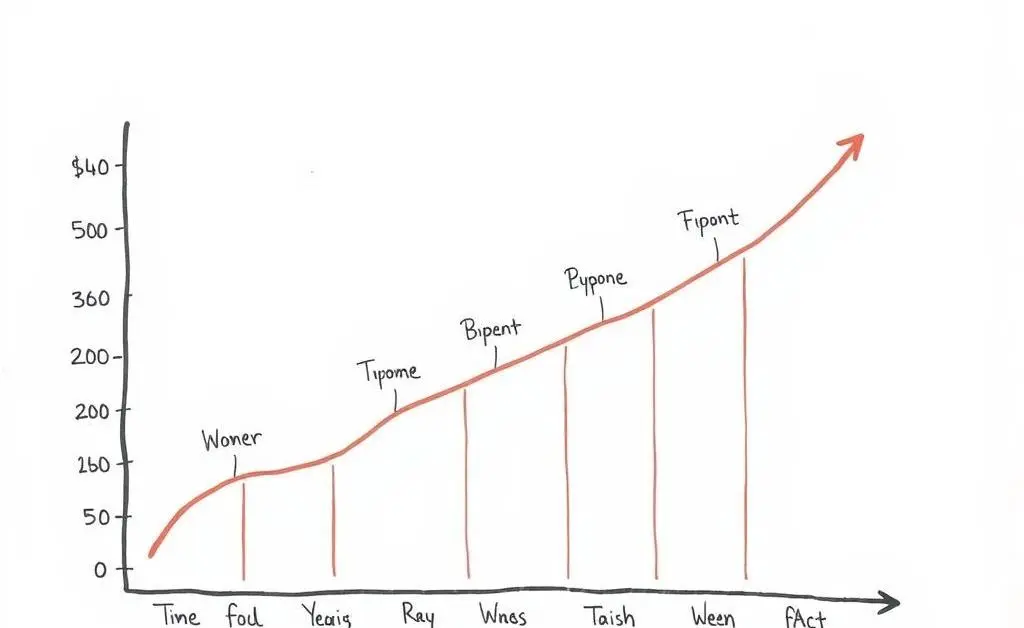

- Financial Milestones Achieved: Perhaps you've reached a significant financial milestone that fulfills your original investment goals. Moving on might be the best way to capitalize on your success.

- Market Conditions Shift: External factors like market prices peaking or declining can influence your decision. Check reliable market trend sources to help guide your timing.

- Portfolio Diversification Needs: If your portfolio feels unbalanced, exiting one of your real estate deals might give you the flexibility to explore other investment opportunities.

When the Emotional Factor Plays a Role

Investments are not just about numbers. They've got a sneakily emotional aspect. Ask yourself:

- Do I feel overwhelmed with managing this property?

- Is it hindering my peace of mind more than adding value?

Answering these queries could unshroud the path ahead, helping you decide if it’s time for an exit.

Planning Your Exit Strategy

Developing a clear and strategic exit plan can make all the difference. Start with a vision of where you are and where you want to be, financially and personally. Drafting spreadsheets or using budgeting apps can be practically beneficial. Consider reading resources like SEC guidelines on real estate investments for additional insights.

Executing with Confidence

Now that you’ve outlined your strategy, it’s time to execute with high spirits. Remember, your exit decision impacts your future ventures — both personally and financially. Staying informed and confident will go a long way.

Reflect and Reassess

After your exit, take a moment to reflect on what worked and what didn’t. Experience is the best mentor for any future property investments. Dive into helpful reflection exercises or consider seeking advice from trusted financial advisors if you’re looking for external guidance.

Takeaway

Exiting doesn't mean giving up; it's about smart transitions. Having a well-rounded exit strategy and the willingness to listen to your financial instincts can unravel opportunities for future growth. So, what signs do you consider before making an exit? I'd love to hear your thoughts!