Demystifying Credit Cards: How to Use Them Wisely

Learn practical tips to leverage credit cards for financial advantage.

Hey there, friend! Today I want to talk about a topic that can be pretty divisive: credit cards. They’re often seen as either a financial lifesaver or a quick path to debt, but when used wisely, credit cards can be a fantastic tool in your personal finance arsenal. Let's dive into some practical tips to get the most out of them.

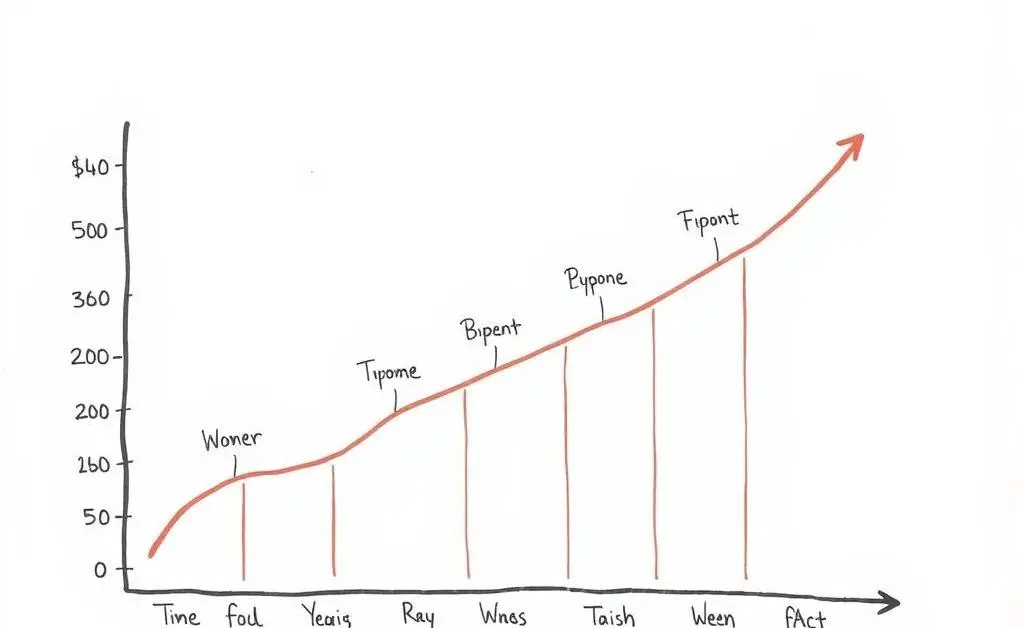

Why Use Credit Cards?

First off, let's address a common question: why bother with credit cards at all? Well, credit cards can help you build credit history, earn rewards, and offer buyer protection. All of these benefits can give you a financial edge if managed correctly.

Choosing the Right Card for You

Not all credit cards are created equal. It's important to find one that matches your financial habits and goals. Do you travel often? A card with travel rewards might be best. Prefer cash back? Look for cards offering solid cash back on purchases you're already making. You can learn more from trusted resources.

Consider Your Spending Habits

Take a moment to reflect on where your money goes each month. Are you dining out regularly, or are most of your expenses on groceries and household items? This self-awareness can steer you toward a card that maximizes your rewards without altering your spending.

Smart Usage

Using credit cards wisely involves a few golden rules. Pay your balance in full each month to avoid interest, and set up autopayments to dodge missed due dates. This way, you can benefit from rewards without falling into the interest trap.

Building Confidence with Your Credit

It’s easy to feel overwhelmed by credit card jargon or the fear of debt. But remember, confidence comes from knowledge and self-awareness. Track your spending with budgeting tools and regularly check your credit score. Knowing where you stand can make a massive difference in how comfortable you feel about your financial choices.

A Takeaway Thought

Credit cards don’t have to be scary. With the right approach, they can be one of your most valuable financial tools. Are you ready to unlock the potential of your credit card? Or perhaps you’ve already uncovered an amazing credit card hack? Share your thoughts and questions below!