Demystifying Dividends: A Beginner's Guide to Smart Investing

Explore dividend investing with friendly insights and practical tips for beginners.

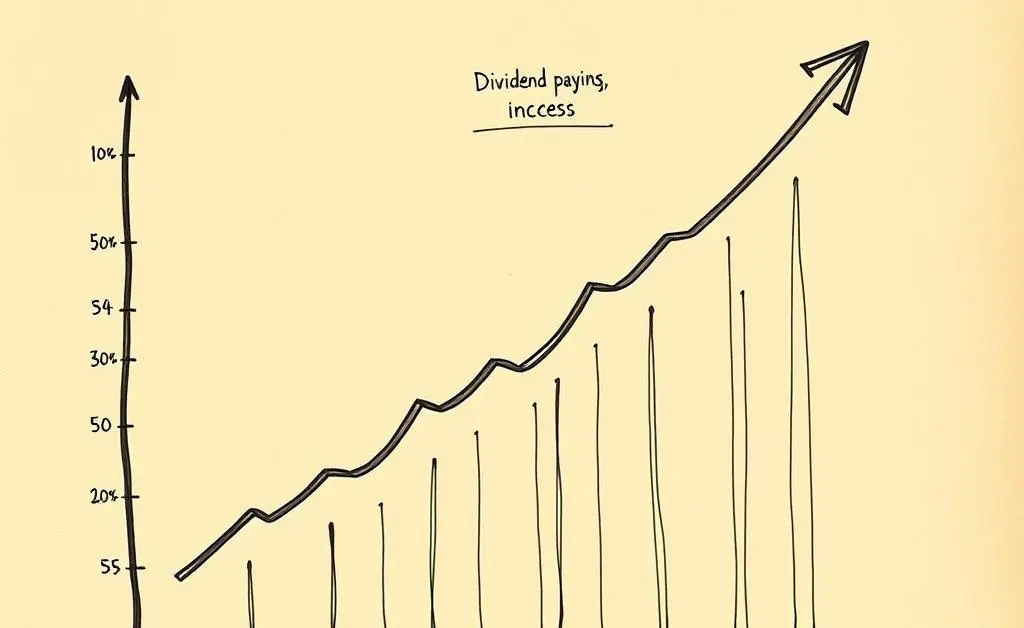

Why Consider Dividend Investing?

Have you ever wondered how some investors seem to earn money without constantly trading stocks? The magic word here is dividends. As a beginner in investing, understanding dividends opens up a world where your money grows while you sleep.

Dividend investing involves buying stocks that pay you a piece of the company's profits. It sounds like a dream, doesn't it? But how does it all really work, and is it the right fit for you?

Breaking Down the Basics

Picture this: You invest in a company, and at the end of the year, they reward you with a portion of their profits, like receiving a thank you card with a little something extra. This extra something is your dividend.

- Consistent Income: Dividends provide regular income, perfect for diversifying your investment strategy.

- Reinvestment Opportunities: You can reinvest dividends to buy more shares, boosting your potential future returns.

- Less Volatility: Dividend stocks are generally less volatile than non-dividend stocks, offering some peace of mind.

Getting Started: Tips for Beginners

When I started my investment journey, the sea of terminologies and numbers felt overwhelming. But, as with any adventure, you start with baby steps.

Do Your Research: Find companies with a track record of consistent dividend payments. Think of these as the honor roll students of the stock world.

Diversify Your Portfolio: Don’t put all your eggs in one basket. Spread your investments across various sectors.

Stay Informed: Keep up with market trends and news. This helps you make informed decisions about your investments.

A Tale of Caution

Not every dividend stock is a golden ticket. Once, I enthusiastically invested in a stock solely because it offered high dividends. However, I hadn’t checked the company's overall health, and soon, they cut their dividends and their stock value plummeted. Lesson learned: High dividends should never be the only reason for picking a stock.

Final Thoughts

Dividend investing can be your passport to financial growth and stability. While it might seem daunting at first, with the right resources and a bit of patience, you can start building a rewarding portfolio.

Are you ready to dive into the world of dividend investing? What strategies would make you feel comfortable starting this new financial journey?