Demystifying Financial Planning for Beginners: Simple Steps to Secure Your Future

Discover key steps to simplify financial planning for a secure future.

Hey there! It's time to tackle a topic that can feel a tad overwhelming but is honestly quite empowering once you get the hang of it: financial planning. Whether you’re saving for a vacation or eyeing that cozy retirement cottage someday, understanding how to manage your finances can transform those dreams into realities.

Where to Begin with Financial Planning?

Before diving into investment strategies or poring over complex mortgage details, start with the basics. The primary keyword here is 'budgeting for beginners'. Creating a budget might sound as appealing as watching paint dry, but it's your financial blueprint. List your income sources and organize your expenses into buckets like essentials, savings, and fun money.

Getting Clear on Your Goals

First things first, let’s chat about goals. Personal finance is deeply personal, surprise, surprise! Are you saving for a rainy day, or perhaps planning to travel the world? Write down at least three financial goals. This exercise turns abstract numbers into something personal and motivating.

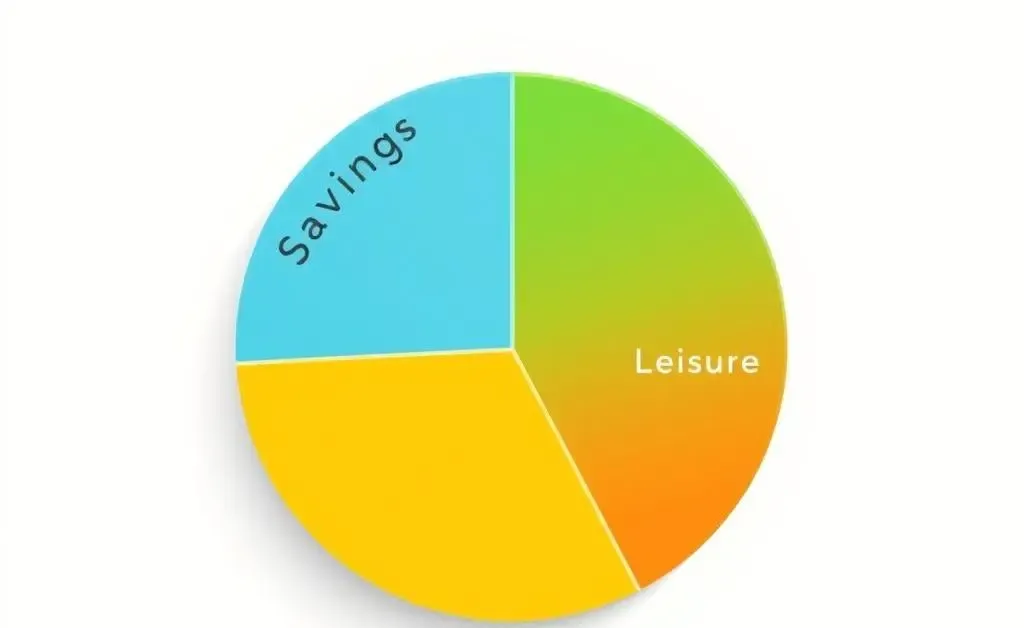

Budgeting: The Cornerstone of Financial Planning

Your next step is creating a budget. Nothing too fancy – just a clear look at where your money is heading every month. Divide your spending into categories, and voila! You've got a pie chart of your life:

- Essentials: Rent, utilities, groceries

- Savings: Emergency fund, retirement

- Leisure: Hobbies and entertainment

Decoding Investments for Newbies

Here's where it gets (a little) exciting. Feel like dabbling in stocks, bonds, or maybe those fancy ETFs? Start with the basics: an index fund could be your best friend. Remember, investing is like planting a tree; the sooner you start, the more it grows.

Must-Know Tips for Managing Debt

If you're juggling student loans or credit card debt, prioritizing these is crucial. Use strategies like the avalanche method (focusing on high-interest debts first) to clear them efficiently. Less debt means more wiggle room for your future plans.

Is Financial Planning Only for Numbers People?

Nope! You don’t need to be a math whiz to master your finances. It’s about getting informed, asking questions, and making informed decisions that align with your life goals.

Ultimately, financial planning is all about proactive choices. Whether it's saving a bit more this month or investing in your first mutual fund, each step you take is an investment in peace of mind. Got any other tips or questions about financial planning? Let's chat in the comments below!