Demystifying Financial Planning: Simple Steps for Everyday Success

Unpack financial planning basics with our simple, practical guide. Start planning your future today.

Have you ever felt overwhelmed by the idea of financial planning? You're not alone. Many of us grapple with how to get started, what steps to take, and how to make it all feel a bit less daunting.

Why Financial Planning Matters

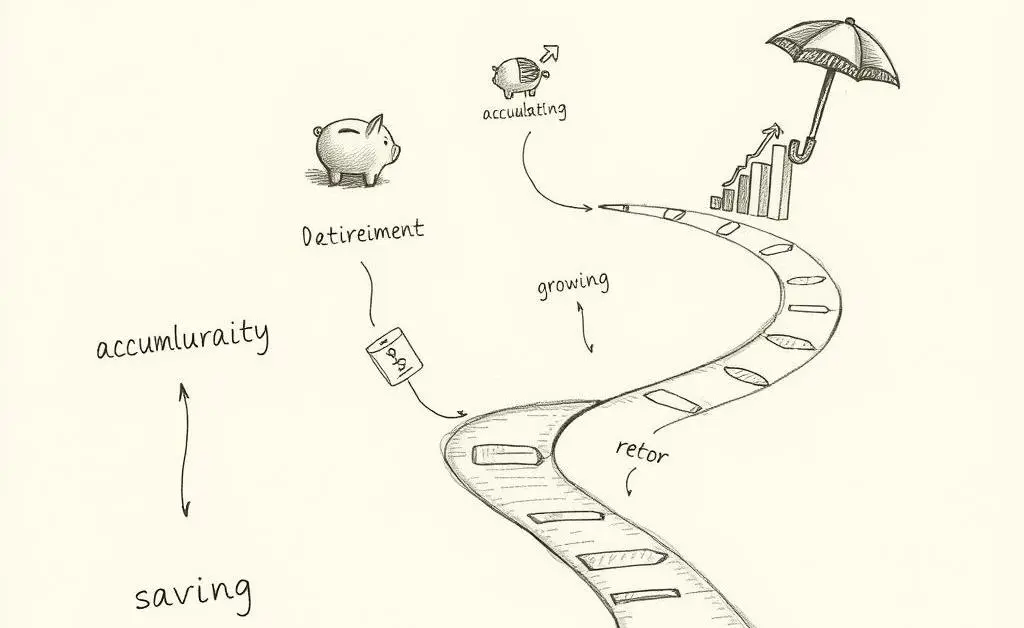

Let's kick things off by understanding the primary keyword: financial planning. It’s the backbone of a stable financial life, allowing us to strategize our savings, manage debt, and prepare for retirement. One of the common reasons peop1e put off financial planning is the misconception that it’s too complicated or only for the wealthy. I’m here to tell you that's not the case, and it starts with a little organization and a few key steps.

Steps to Kickstart Your Financial Journey

- Create a Budget: Begin by documenting all your income sources and expenses. This provides a clear picture of your cash flow and helps in identifying any unnecessary spending.

- Set Clear Goals: Whether it’s buying a home, vacationing, or retirement, defining your financial goals gives you a target to aim for.

- Build an Emergency Fund: Aim to save at least three to six months' worth of living expenses. This fund is your cushion for unexpected life events.

- Invest Wisely: Starting small is okay; the key is consistency. Explore diverse investment options that suit your risk tolerance.

Budgeting: Your Financial Best Friend

Budgeting is your foundational step and it’s more approachable than it looks. Start by using budgeting apps or simple spreadsheets to organize your finances. Trust me, when you see where your money is going, it feels like turning the light on in a dark room.

Common Budgeting Tools

You don't need to reinvent the wheel. Tools like You Need A Budget (YNAB) or Mint can make this task straightforward and even enjoyable.

Reflect and Revise

Remember, financial planning is not a one-off task. Regularly revisit and adjust your plan as your life and financial circumstances evolve. This habit keeps you aligned with your long-term objectives and helps tackle any challenges with foresight.

Do you have any tips for staying on track with financial goals? Share them in the comments below, and let's embark on this journey together!