Demystifying PMI: What It Is and How to Avoid It Comfortably

Learn what PMI is and discover savvy ways to avoid it when buying a home.

Ever wondered why people keep talking about PMI when you're just trying to buy a place to call home? Well, buckle up, because we're about to dive into what Private Mortgage Insurance (PMI) really is and how you can skillfully sidestep it. Trust me, understanding this can be the difference between smooth sailing and unexpected turbulence in your home-buying journey.

What's PMI, Anyway?

Let's start with the basics. Private Mortgage Insurance, or PMI, is a type of insurance that some lenders ask homebuyers to take on when they're not putting down at least 20% of the home's value. It's a way for lenders to protect themselves against the risk of you defaulting on the loan.

Now, you might be thinking, "Great, another loan, another cost!" And you're not wrong. PMI is generally added to your monthly mortgage payment, which can feel like a constant extra load.

How Can You Avoid PMI?

Alright, so avoiding PMI - is it even possible? Absolutely! Let's look at some practical ways:

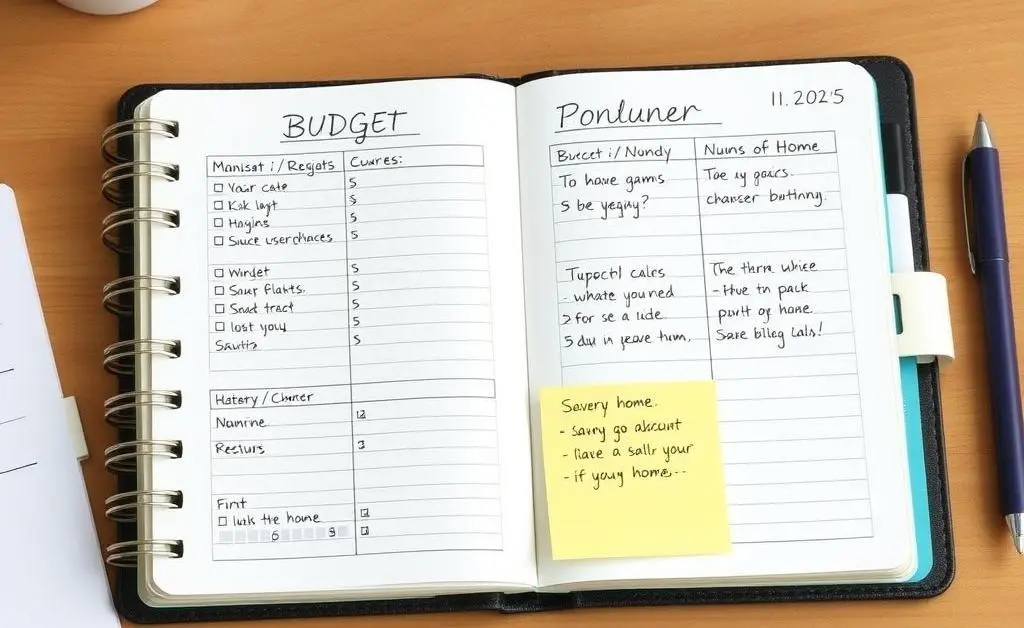

- Save for a Larger Down Payment: Start planning early and aim to save up at least 20% for your down payment. This is the most direct way to dodge PMI.

- Consider a Piggyback Loan: Also known as an 80-10-10 loan, this involves taking out a second 'piggyback' loan at the same time as your mortgage to cover part of the down payment.

- Look for Lender-Paid PMI: Some lenders offer options where they pay the PMI, but watch out for higher interest rates in return.

Once, a friend of mine, let's call her Jane, was intent on keeping her monthly payments low. She managed to avoid PMI by strategically combining a small inheritance with her savings to reach the 20% down payment mark. Talk about a smart move!

Is Avoiding PMI Always the Best Choice?

Avoiding PMI sounds like a no-brainer, right? But context matters. If you're in a booming real estate market where prices might outpace your savings, it may make more sense to proceed without that hefty down payment and pay PMI temporarily while the value of your home appreciates.

Bear in mind, PMI isn't forever. Once you've paid down your mortgage to 80% of the home's original value, you can request to cancel it.

So, What's the Best Strategy for You?

Take a step back and assess your financial situation and goals. Are you comfortable waiting while saving up for a bigger down payment, or would owning sooner bring you greater joy and financial advantage? Each path has its perks and pitfalls.

Finally, I'd love to hear your thoughts: Have you ever encountered the PMI obstacle on your home-buying journey, and how did you manage it? Feel free to share your stories!