Demystifying the World of Mortgages: Everything You Need to Know

Explore the essentials of mortgages with friendly insights and practical advice.

Hey there! Navigating the world of mortgages can feel like stepping into a financial maze, don't you think? But fear not, I've been down this road before, and I'm here to share some friendly insights that might just help you on your journey. Whether you're a first-time homebuyer or looking to refinance, this is your guide to understanding the essentials of mortgages.

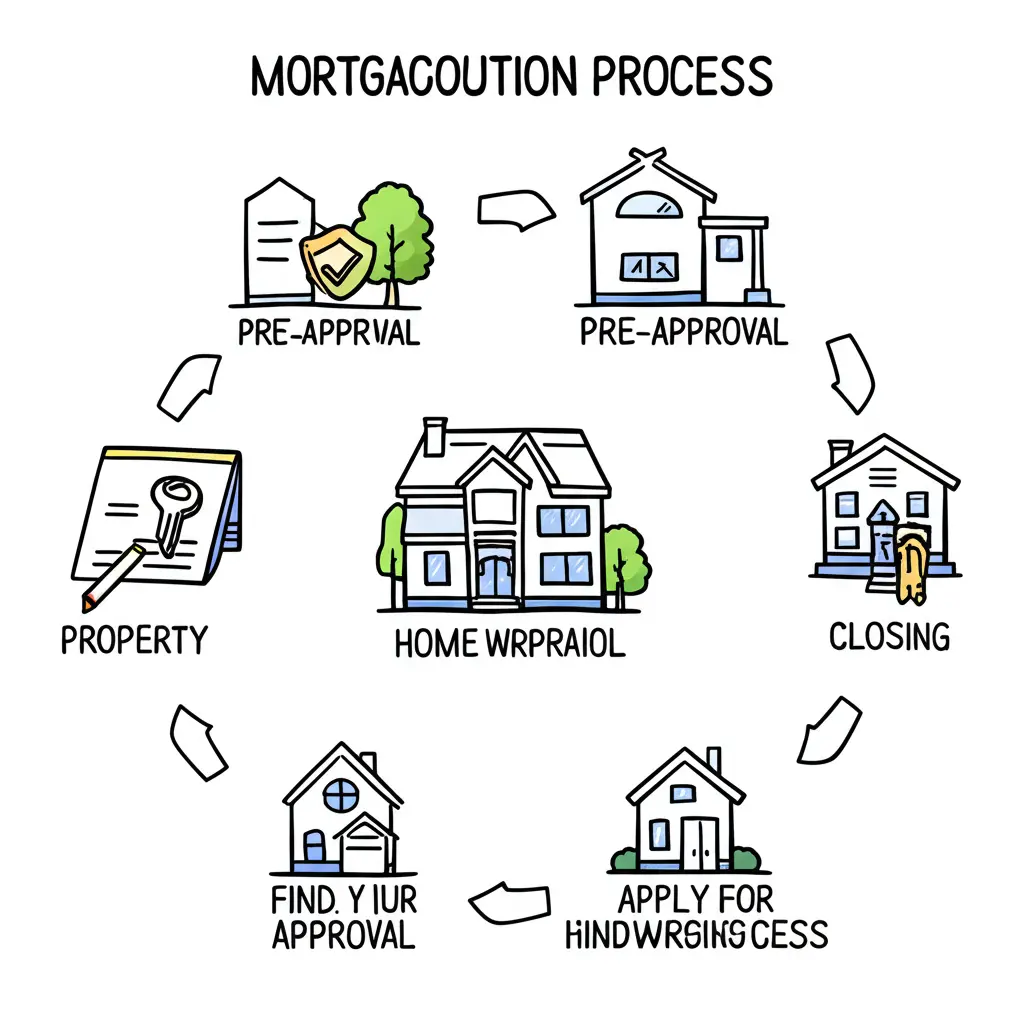

What is a Mortgage?

Let's start at square one. Simply put, a mortgage is a loan specifically used to purchase a home. It involves you, the borrower, getting funds from a lender to buy a property, which you then pay back over time, usually in monthly installments. The house itself acts as collateral, securing the loan.

Key Elements of a Mortgage

Here are the basic components you'll encounter:

- Principal: The original amount borrowed.

- Interest Rate: The cost of borrowing that principal.

- Term: The length of time over which you’ll repay the loan, often 15 to 30 years.

- Down Payment: Initial payment made to reduce the overall loan amount.

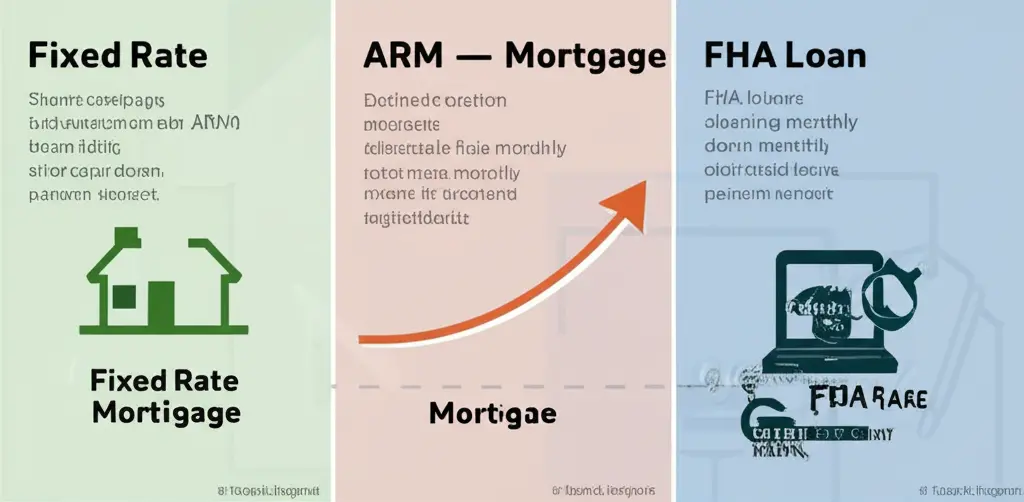

Types of Mortgages

With so many options, how do you know which mortgage type fits you? Here's a quick rundown:

- Fixed-Rate Mortgage: Steady interest rate, predictable payments.

- Adjustable-Rate Mortgage (ARM): Rates might change after an initial fixed period.

- FHA Loans: Great for first-time buyers with lower down payments.

- VA Loans: Special options for veterans and active military members.

How to Choose the Right Mortgage?

Finding the right mortgage is crucial. Consider your financial situation, how long you plan to stay in the home, and how comfortable you are with payment fluctuations. Take your time comparing different terms and rates. It’s always a good idea to consult a financial advisor or mortgage broker to ensure you make an informed decision.

Mistakes to Avoid When Getting a Mortgage

Navigating this process can be tricky, so here are a few pitfalls to steer clear of:

- Ignoring the total cost of a mortgage, not just the monthly payment.

- Overlooking fees and closing costs, which can add up quickly.

- Skipping the step of getting pre-approved, which helps position you as a serious buyer.

Conclusion

Grandma always said the best things in life take time and thought—and a mortgage is no exception! It isn't just a loan; it's a key to your future home and financial well-being. So take a deep breath, use this guide to light your way, and you’ll be on the path to making informed and confident steps. Got any personal stories or questions about mortgages? Let me know in the comments!