Demystifying Your First Credit Card: A Guide to Building Confidence and Credit

Starting with credit cards? Learn how to manage credit wisely, avoid common pitfalls, and build a strong credit score.

Dipping a Toe into the Credit World

Picture this: you've just received your first credit card in the mail. It's an exciting milestone, like a new world opening up, yet there's a tinge of apprehension. Will you be able to manage it well, or might you tumble into debt? Let's explore how to use this new tool wisely and with confidence.

Understanding Your Credit Card

No need to stress—learning the ropes of your credit card doesn't have to be an overwhelming experience. This card is essentially a short-term loan, allowing you to buy things and pay later while having the opportunity to build your credit score, a numerical representation of your creditworthiness. It's crucial to know your card's key features, like the credit limit, interest rates, and due dates, to stay in control.

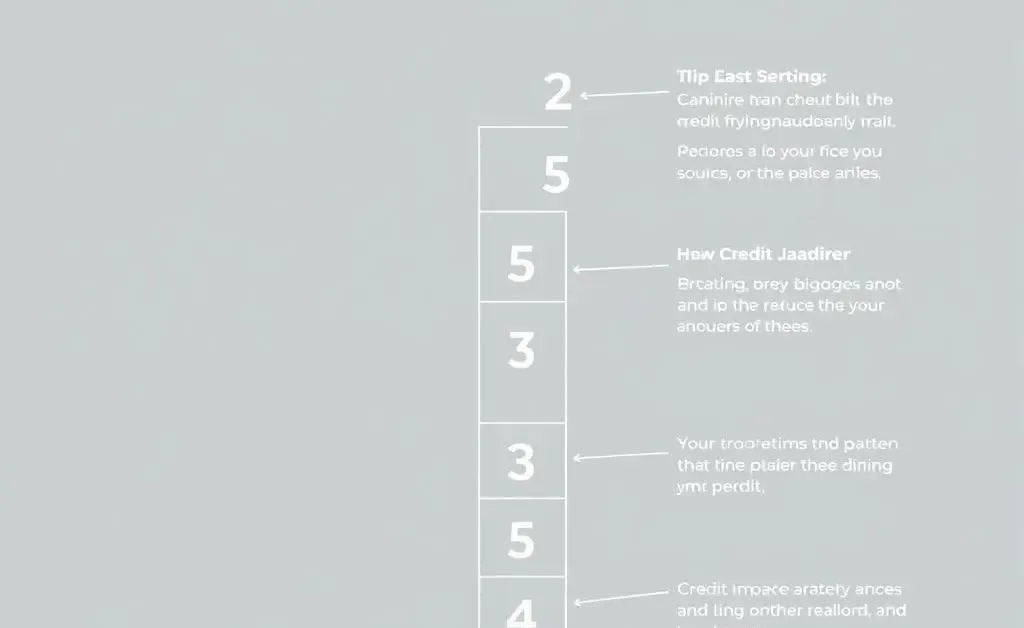

Credit Limits: Your New Best Friend

Think of your credit limit as a helpful guide, setting boundaries to keep your spending in check. Using less than 30% of your limit is generally a good practice and can positively affect your credit score. For instance, if you have a $1,000 limit, aim to keep your balance below $300.

Paying Timely: The Key to Success

Paying your balance on time is like watering a plant—you need to nurture it consistently to see growth. Late payments can harm your credit score significantly, so consider setting up reminders or automatic payments to stay on track.

Building Credit: Step by Step

Rome wasn't built in a day, and neither is a stellar credit score. Start by using your card for small, manageable expenses, ensuring you pay off the entire balance each month. Over time, this practice will reflect positively on your credit report.

Common Pitfalls and How to Avoid Them

It's easy to be swayed by special offers and rewards, but staying grounded in your spending habits is vital. Don't let the allure of accumulating rewards justify unnecessary spending or overextending your budget.

Wrapping Up: Growing with Your Credit Card

Embracing your first credit card is a significant step toward financial independence. Remember, it's more than just plastic; it's a tool that, when used wisely, can open doors to greater financial opportunities, such as loans for education or a future home.

Take each transaction thoughtfully, learn as you go, and before you know it, you'll be well on your way to mastering your credit journey.