Dividend Stocks: A Safe Harbor in Economic Downturns

Explore how dividend stocks can offer stability in economic downturns.

Let's face it; economic downturns aren't exactly a walk in the park. They're more like trying to walk your cat — unpredictable and a little bit hairy. But one thing many seasoned investors swear by during these turbulent times is the reliability of dividend stocks.

Why Dividend Stocks Shine in Rough Waters

Here's the deal: dividend stocks are like those loyal friends who stick around even when the chips are down. They routinely pay you dividends, which could be a steady source of income. When the stock market's rollercoaster isn't in your favor, those little dividend checks can feel like rays of sunshine on a cloudy day.

Defensive Sectors to Consider

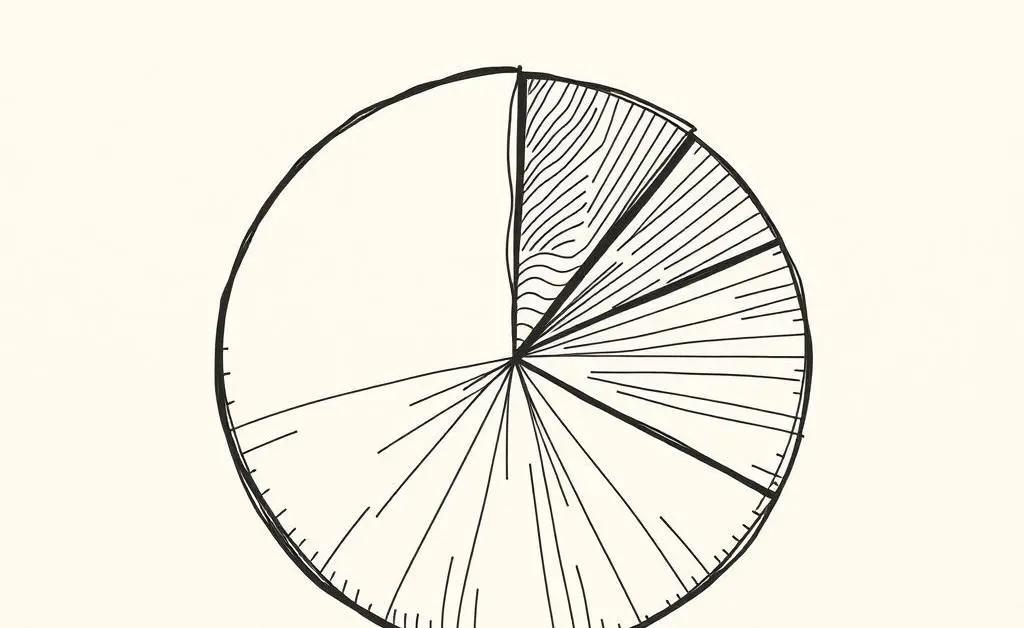

Diversifying within dividend stocks is key. Here are some sectors that often weather the storms better:

- Consumer Staples: Companies selling products that people buy regardless of economic conditions, such as food and hygiene products.

- Utilities: Essential services like water and electricity tend to hold steady.

- Healthcare: In any economy, health remains a priority.

The Emotional Side: Handling Your Mental Portfolio

I'll never forget a chat with my friend Jake over coffee, where he confessed he'd gone full-investment mode in tech stocks right before the last downturn. The result? Let's just say it wasn't pretty. Now, he swears by dividend stocks for at least a part of his portfolio, appreciating the gentle reminder that not everything in investing has to be a gamble.

Holding dividend stocks can act as a psychological anchor, reminding you of stability amidst market turbulence.

Are Dividend Stocks Right for You?

In a world where market predictions can swing from happy-go-lucky to doomsday overnight, dividend stocks offer a measure of security. Think of them as a financial cushion. However, it's always crucial to do your research or consult with a financial advisor to tailor your portfolio to suit your needs.

What are your thoughts on dividend stocks as a buffer during economic downturns? Do you think they'd be a good fit for your investment strategy?