Exploring High-Dividend Yield Strategies: Smart Tips for Investors

Discover practical insights into high-dividend yield strategies for maximizing your investment returns.

Investing can often feel like navigating a maze. There’s always some new strategy popping up that promises great returns. One that’s been gathering attention is the high-dividend yield strategy. So, what’s the deal with it? Let’s dive in.

What is a High-Dividend Yield Strategy?

Put simply, this strategy focuses on investing in stocks that provide high dividend returns. Dividends are a portion of a company’s profits paid out to shareholders. Prioritizing these stocks can yield consistent income, which is appealing for many investors.

Why Consider High-Dividend Stocks?

Here are a few reasons why this strategy might catch your interest:

- Steady Income: Who doesn’t love a regular paycheck? These dividends provide a reliable income stream.

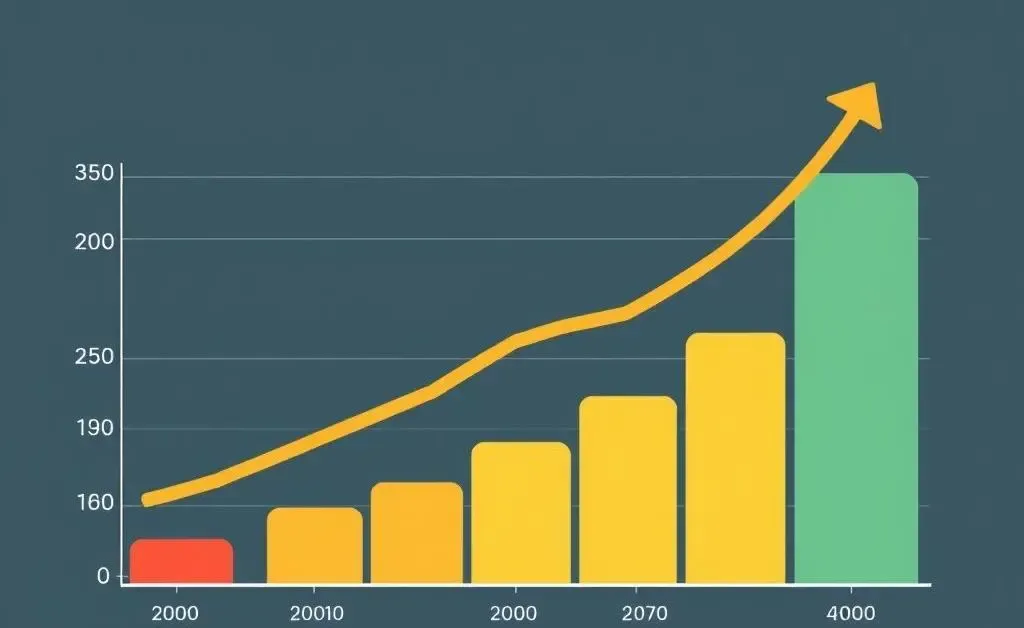

- Inflation Hedge: Historically, dividend-paying stocks have shown resilience to inflation.

- Potential for Appreciation: Some companies growing dividends also increase their stock value over time.

Potential Risks

No strategy is without its caveats. High-dividend yield stocks come with their own set of risks.

- Economic Sensitivity: These stocks can be negatively impacted by economic downturns.

- Dividend Cuts: There’s always a risk that a company might reduce or stop dividends.

- Concentration Risk: Over-reliance on a few high-dividend stocks can be risky.

How to Choose the Right Stocks

Choosing the right stocks for a high-dividend yield strategy involves research and diligence. Here’s a simple approach:

- Understand the Payout Ratio: A lower payout ratio suggests sustainability.

- Consider the Industry: Some industries are traditionally more stable, like utilities.

- Diversify: Spread your investments across a variety of sectors.

Wrapping It Up

Investing in high-dividend yield stocks can certainly be rewarding, especially if you’re looking for steady income. Like any investment, it’s essential to weigh the potential rewards against the risks. So, have you given any thought to incorporating dividend stocks into your portfolio?