Exploring IPOs: A Beginner's Journey Into Initial Public Offerings

Uncover the world of IPOs: benefits, risks, and personal insights to navigate these investment opportunities.

Welcome to the world of IPOs, or initial public offerings! If you've ever contemplated diving into the stock market, you might have wondered about this seemingly glamorous gateway to potentially lucrative investments. Having pondered it myself, let's explore what you truly need to know about IPOs.

What Exactly Is an IPO?

An IPO marks a landmark moment for a private company. It's when they decide to 'go public' by offering shares for the first time on a stock exchange. For a company, it's an opportunity to raise capital. For investors, it presents a chance to grab shares at possibly the base level — though it's not as straightforward as it sounds.

Why Consider Investing in an IPO?

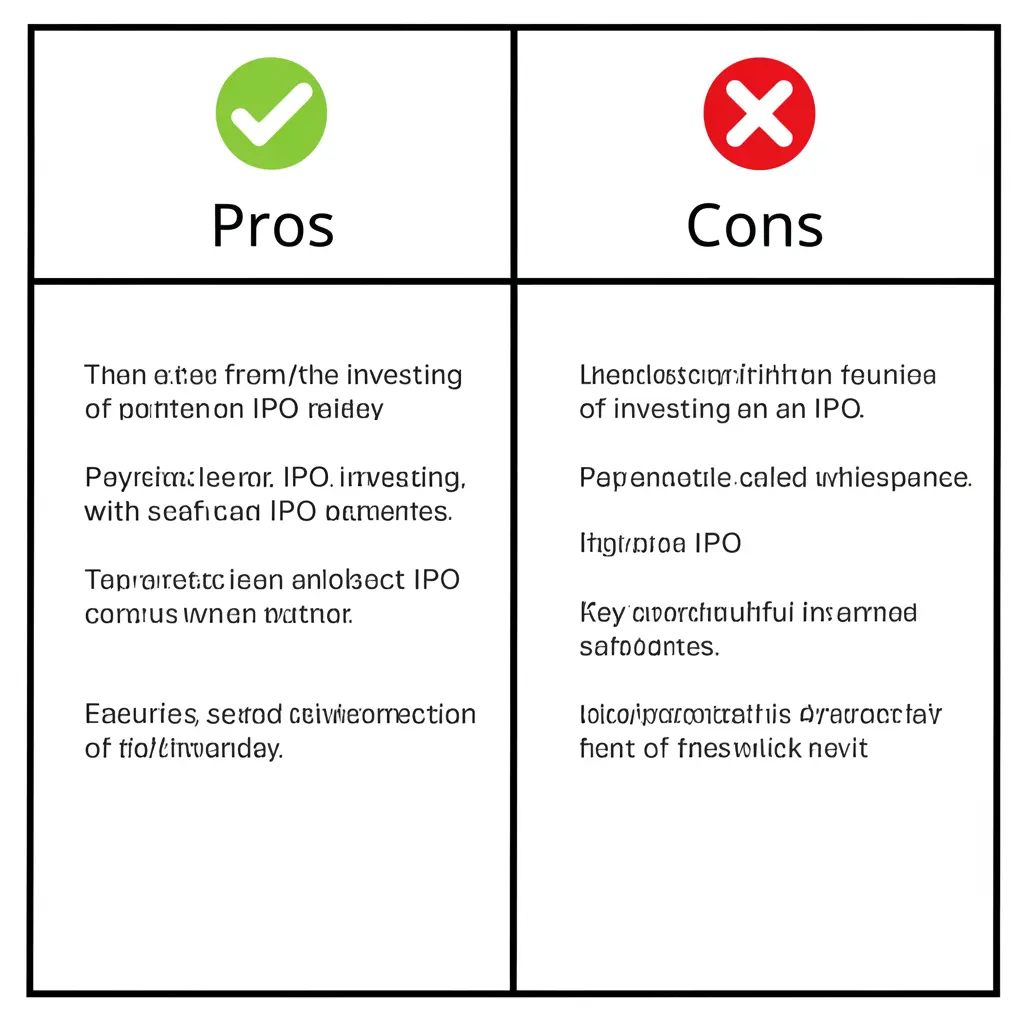

Investing in IPOs can be thrilling. Here are some benefits potential investors consider:

- Access at Ground Level: You could acquire shares before they're widely available.

- Opportunity for High Returns: Many IPOs experience a significant "pop" in price right after they begin trading.

- Diversifying Your Portfolio: IPOs could introduce you to new and innovative industries.

The Flip Side: Risks to Keep in Mind

But don't just dive in without understanding the risks.

- Market Volatility: IPOs can be highly volatile, with prices that might skyrocket or plummet quickly.

- Limited Historical Data: New public companies lack historical data, making valuation tricky.

- Unproven Business Models: Many IPOs are of companies still proving their market fit.

Lessons Learned from the IPO Experiences

Those who've ventured into IPO terrain often emphasize patience and research as key. One friend once said, "An IPO is a marathon, not a sprint." It's wise to comb through financial statements and understand the business strategy before committing. While stories of hitting the jackpot are enticing, remember, they're often the exception.

Practical Tips for New IPO Investors

You're thinking about taking the plunge. Great! Here’s a simple roadmap:

- Do Your Homework: Understand the company, its competitors, and its financial health.

- Define Your Investment Budget: Decide how much you're willing to invest (and potentially lose).

- Keep Emotions in Check: Don't get swept up by hype; stick to your strategy.

- Consider Long-Term Potential: Look beyond the initial buzz and evaluate long-term potential.

Final Thoughts: Your IPO Adventure Awaits

Diving into IPO investing can be both exciting and rewarding if approached thoughtfully. As with any investment, it's essential to weigh the risks against potential rewards. So, are you ready to embark on this journey?

What do you think, would you take the plunge into IPOs, or are you more of a seasoned chip-and-dip investor?