Feeling Behind in Your 30s? Here's How to Find Your Financial Focus

Feeling financially lost in your 30s? Discover practical steps to regain focus and take control of your future.

Have you ever found yourself staring at your bank statement, wondering where all the time—and money—went? You're not alone. Many of us reach our 30s and suddenly feel like we're miles behind in the financial game. Let's unpack this together and explore some gentle yet effective ways to put you back on the path toward financial peace.

Why Do We Feel Behind?

There's a common saying that comparison is the thief of joy, and nowhere is this truer than in the realm of finances. Social media doesn't help; seeing friends and colleagues posting about their latest investments or dream vacations can make us feel like we're playing catch-up. It's crucial to remember that everyone’s journey is unique, including yours.

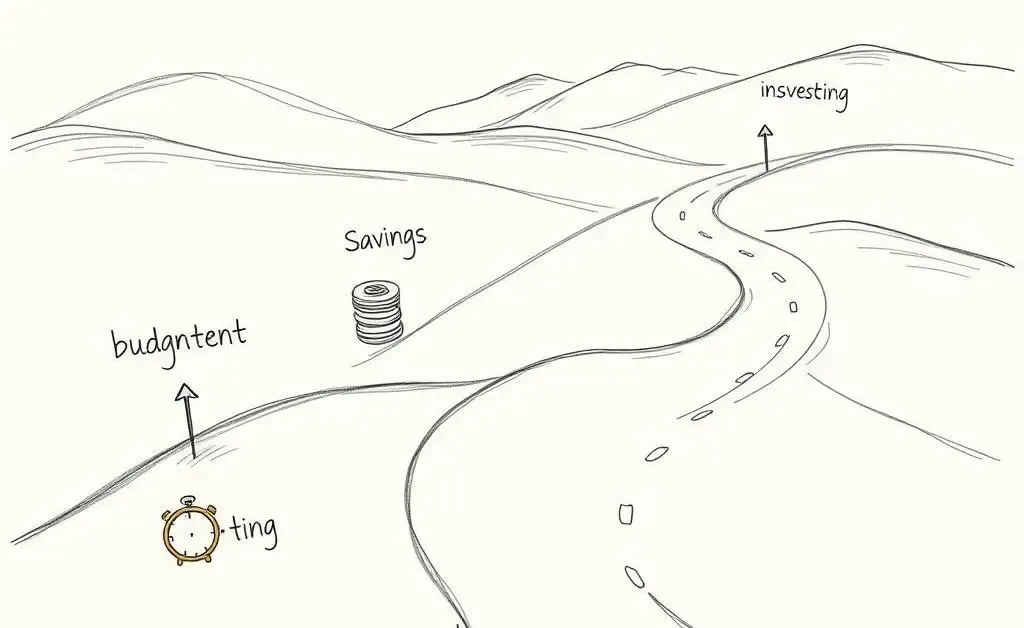

Creating Your Financial Roadmap

If the idea of a financial roadmap sounds daunting, think of it like planning a road trip. You wouldn't set off without a map, right? Start by setting small, achievable milestones.

- Budgeting: This is your starting point. Begin with a simple budget and gradually refine it as you get more comfortable.

- Saving: Implement the habit of saving regularly. Even small contributions can build up over time.

- Investing: Once you have a decent emergency fund, consider low-risk investments. Consultancy with a financial advisor can provide tailored advice.

- Retirement Planning: The sooner, the better. Look into retirement plans that fit your lifestyle and goals.

Nurturing Healthy Financial Habits

Something magical happens when we embrace our current circumstances and work from there. If coffee chats with friends are your thing, why not bring finance into the convo? It often leads to discovering new insights or resources you hadn't considered before.

Tuning into Emotional Well-being

It's perfectly okay to feel overwhelmed. But your mental health is intertwined with your financial health, so tending to it is important. Consider journaling or meditation as methods to process stress, or reach out to a professional for support.

Remember, there's no standard timeline for success—financial or otherwise. By focusing on realistic goals and respecting your unique path, you'll find that financial stability becomes a natural extension of your life. So let's take a deep breath, appreciate our progress, and look forward to what comes next.

What are your thoughts on this journey? I'd love to hear from you in the comments.